Loading

Get Form Gst Drc 04

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM GST DRC 04 online

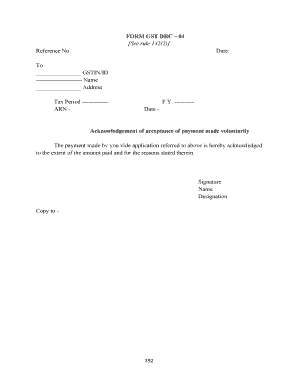

Filling out the FORM GST DRC 04 is a crucial step for users who wish to acknowledge the payment made voluntarily. This guide will provide step-by-step instructions to help you through the online process effectively.

Follow the steps to complete the FORM GST DRC 04 online.

- Press the ‘Get Form’ button to retrieve the form and access it in the editor.

- Enter the reference number in the designated field to uniquely identify your application.

- Input the date in the specific format required, ensuring accurate record keeping.

- Fill in your GSTIN/ID in the appropriate section, ensuring that it is correct and up-to-date.

- Provide your name as it appears on official documents within the designated field.

- Complete the address section with your current registered address to ensure proper communication.

- Specify the tax period relevant to your payment in the next field.

- Enter the ARN (Application Reference Number) in the provided space for tracking your application.

- Fill in the financial year (F.Y.) relevant to the form submission, using the standard year format.

- Lastly, confirm the date of payment in the corresponding field to validate this entry.

- Review all entered information for accuracy, ensuring that no errors are present.

- Once you are satisfied with your entries, you may save your changes, download, print, or share the completed form as needed.

Complete your documents online today to streamline your GST process.

Access the .gst.gov.in URL. ... Select the Intimation of Voluntary Payment - DRC - 03 from the Application Type drop-down list. ... The intimation of payment made voluntary or made against the show cause notice (SCN) or statement or intimation of tax ascertained, through FORM GST DRC-01A, page is displayed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.