Loading

Get Ca Application For Business Tax Certificate - City Of Bakersfield 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Application For Business Tax Certificate - City Of Bakersfield online

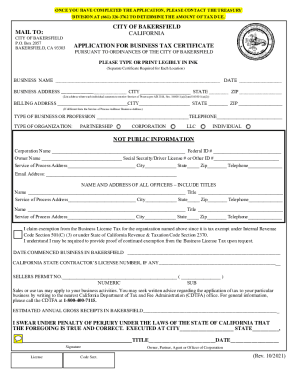

Filling out the CA Application For Business Tax Certificate is an important step for establishing your business in the City of Bakersfield. This guide provides clear, step-by-step instructions to help you complete the application online with ease.

Follow the steps to successfully fill out your application.

- Use the ‘Get Form’ button to access the CA Application For Business Tax Certificate and open it in your preferred online platform.

- Begin by entering your business name in the designated field provided at the top of the form. Ensure this is accurate, as it will be used for identification purposes.

- Fill in the date of application in the format requested. This section is crucial for processing your submission.

- Input your business address, including street, city, state, and zip code. This is where service of process will be sent, as per the relevant regulations.

- If your billing address differs from the business address, provide the correct billing address information, including city, state, and zip code.

- Specify the type of business or profession you are engaged in and provide a telephone number where you can be reached.

- Select your type of organization from the options provided: partnership, corporation, LLC, or individual.

- If your business is a corporation, enter the corporation name and federal ID number.

- For individual owners, provide your name along with your Social Security number, driver’s license number, or other applicable identification number.

- Complete the service of process address, making sure to include the city, state, zip code, and a contact telephone number.

- List the email address for correspondence purposes.

- Enter the names and addresses of all officers associated with your business, ensuring to include their titles, service addresses, and telephone numbers.

- If applicable, indicate your exemption from the Business License Tax and provide any necessary proof if requested.

- Record the date you commenced business operations in Bakersfield.

- If relevant, enter your California State Contractor’s License number and seller's permit number.

- Estimate your annual gross receipts for the business as instructed.

- Review all entries for accuracy and completeness. Once verified, you will be required to sign, swearing under penalty of perjury that the information provided is correct.

- Finally, save your changes. You may download, print, or share the completed form as needed.

Take action now and fill out your CA Application For Business Tax Certificate online.

A business license in California is the permit that allows you to do business within the state and more specifically, the county that you are located in. This is very important because all businesses need to comply with the state regulations for tax reasons.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.