Loading

Get Irs 433-b (oic) 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 433-B (OIC) online

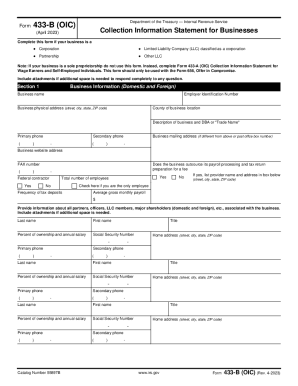

The IRS 433-B (OIC) is a vital form for businesses seeking to submit an Offer in Compromise. This guide provides a comprehensive approach to filling out this form online, ensuring a smoother experience for users, regardless of their legal expertise.

Follow the steps to complete your IRS 433-B (OIC) form.

- Click ‘Get Form’ button to access the IRS 433-B (OIC) form and open it in your preferred editor.

- Begin with Section 1 by providing your business information. Complete fields such as business name, Employer Identification Number, business address, and primary and secondary phone numbers. Include a description of your business and any relevant details.

- In Section 2, gather your business asset information. Detail your cash and investments, including account types and balances. Provide details for all properties, vehicles, and equipment owned by the business, ensuring to round numbers to the nearest dollar.

- Proceed to Section 3 to fill out business income information. Report the average gross monthly income of your business by summarizing your revenue from services, sales, and any other sources. Calculate the total and enter it in Box B.

- In Section 4, document your business expenses over the last 6-12 months. Enter figures for materials, inventory, wages, rent, and all other relevant expenses, ensuring they are appropriately documented in Box C.

- Move to Section 5 to calculate your minimum offer amount. Depending on how you plan to pay, utilize the remaining monthly income entered in Box D, applying the appropriate multipliers to derive your offer amount.

- In Section 6, provide any additional information requested by the IRS that might affect your offer. This includes details about bankruptcy, asset transfers, and related party transactions.

- Finally, in Section 7, sign and date the form, confirming the accuracy of the information provided. Remember to include all required attachments before submission.

- After completing the form, you can save changes, download, print, or share the finalized document based on your preferences.

Begin completing your IRS 433-B (OIC) form online today.

IRS Form 433A- is a tax collection information statement for self-employed personnel and those that earn wages. IRS Form 433B- is a tax collection information statement for businesses. IRS Form 433F- is a generalized tax collection information statement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.