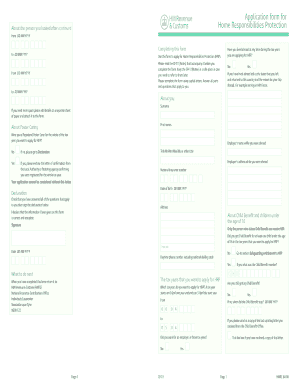

Get Cf411 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cf411 Form online

This guide provides detailed step-by-step instructions on how to complete the Cf411 Form online for Home Responsibilities Protection. Whether you are familiar with online forms or new to the process, this guide will support you in filling out the form accurately and efficiently.

Follow the steps to complete the Cf411 Form online

- Click ‘Get Form’ button to obtain the Cf411 Form and open it in your preferred web editor.

- Begin by reading the Cf411 Notes that accompany the form to ensure you have all the necessary information before filling it out.

- Fill out the sections under ‘About you’. Start with your surname, first names, date of birth, and your National Insurance number.

- Indicate whether you have lived abroad at any point during the tax years relevant to your application. If yes, provide the dates and reasons for your trips.

- Next, address the section related to Foster Caring. State if you were a registered foster carer for the entire tax year you are applying for, and if so, include any additional documentation.

- Proceed to the ‘About Child Benefit and children under the age of 16’ section. Confirm if you received Child Benefit for at least one child under 16 during the relevant tax years.

- If you answered yes, provide your Child Benefit number and confirm your current status regarding Child Benefit payments.

- Finally, after ensuring all questions have been answered and you've checked your entries, sign the declaration and provide your daytime phone number, then save your changes.

- Once the form is completed, you may choose to download, print, or share the form as needed. Follow your preferred method for submission according to the instructions at the end of the form.

Complete your Cf411 Form online today and ensure you receive the support you deserve.

If you get State Pension You cannot get the full amount of both Carer's Allowance and your State Pension at the same time. If your pension is £76.75 a week or more, you will not get a Carer's Allowance payment. If your pension is less than £76.75 a week, you'll get a Carer's Allowance payment to make up the difference. Carer's Allowance: Eligibility - GOV.UK .gov.uk https://.gov.uk › carers-allowance › eligibility .gov.uk https://.gov.uk › carers-allowance › eligibility

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.