Loading

Get Withdrawalrmd Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WITHDRAWAL/RMD REQUEST FORM online

Completing the WITHDRAWAL/RMD REQUEST FORM online can be a straightforward process when guided appropriately. This guide breaks down each section of the form, ensuring that users are well-informed and comfortable with the requirements.

Follow the steps to successfully complete your form.

- Press the ‘Get Form’ button to access the WITHDRAWAL/RMD REQUEST FORM. This will allow you to open the document in an online editor for easy completion.

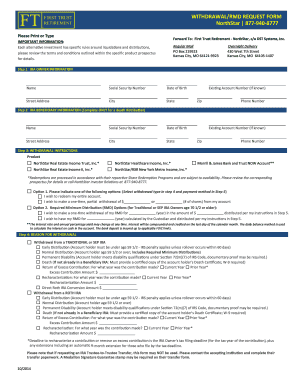

- Enter your IRA owner information in Section 1. You will need to provide your name, social security number, date of birth, street address, city, state, existing account number (if known), zip code, and phone number.

- If applicable, fill out Section 2 for IRA beneficiary information. This section is only necessary if the form is being completed for a death distribution. Provide the name, social security number, date of birth, street address, city, state, existing account number (if known), zip code, and phone number of the beneficiary.

- In Section 3, clearly outline your withdrawal instructions. Choose the product from the list provided and select either the option to redeem your entire account or specify a one-time partial withdrawal amount or share count.

- For required minimum distribution options, if you are a traditional or SEP IRA owner aged 70 1/2 or older, indicate your preference for making a one-time withdrawal of your RMD or for the custodian to calculate the RMD and distribute it according to your instructions.

- Proceed to Section 4 and indicate the reason for your withdrawal by selecting from the provided options related to traditional or Roth IRA distributions, including early distributions, normal distributions, permanent disability, death, return of excess contributions, or recharacterizations.

- In Section 5, choose your preferred payment method. You can opt for either a check to be mailed, an electronic transfer, a cash deposit into your NOW account, or a transfer of shares.

- Complete Section 6 regarding income tax withholding, indicating whether you wish to have taxes withheld from your distribution.

- Finally, in Section 7, sign and date the form to affirm that the information provided is accurate and to authorize the custodian to process your request.

- Once you have filled out all relevant sections and verified your information, save the changes, and you may choose to download, print, or share the completed form as necessary.

Get started now to complete your WITHDRAWAL/RMD REQUEST FORM online.

In 2023, use eFile.com to generate Form 8915-F to report repayment information about your 2020 distribution as applicable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.