Loading

Get Inheritance Tax: Return Of Estate Information (iht205 ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Inheritance Tax: Return Of Estate Information (IHT205) online

Filling out the Inheritance Tax: Return Of Estate Information (IHT205) online can seem daunting, but with the right guidance, you can complete it efficiently. This guide provides you with step-by-step instructions to ensure accurate completion of the form, making the process smoother for you.

Follow the steps to complete the form accurately and easily.

- Click the 'Get Form' button to access the document and open it for editing.

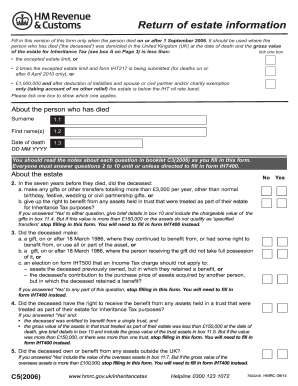

- Begin by filling out your personal information in the ‘About the person who has died’ section. Include the surname, first name(s), and date of death in the specified format (DD MM YYYY). Ensure this information is accurate.

- Proceed to the ‘About the estate’ section. Answer questions 2 to 10 based on the deceased's financial activities, ensuring that you are prepared to provide additional details if prompted.

- For question 2, indicate whether the deceased made gifts or transfers exceeding £3,000 annually in the last seven years. If 'Yes', provide brief details in box 10.

- In question 3, confirm if the deceased made any gifts where they retained some benefit or if the recipient did not take full possession. If so, you will need to stop completing the IHT205 and switch to form IHT400.

- Question 4 asks about any trust benefits the deceased was entitled to. If applicable, provide details and values in the corresponding boxes.

- Continue with question 5 regarding assets held outside the UK, and include their value if applicable. Again, if the total exceeds £100,000, switch to form IHT400.

- Question 6 asks about premiums on insurance policies. If applicable, switch to form IHT400.

- In the ‘Summary of estate’ section, provide a detailed accounting of all assets and liabilities, calculating the gross and net estate for Inheritance Tax.

- Finally, complete the exemptions section by deducting any qualifying exemptions. Make sure to review your calculations carefully.

- Once all sections are completed, save your changes. You can download, print, or share the form as needed.

Start completing the Inheritance Tax: Return Of Estate Information (IHT205) online to ensure a smooth process.

Use the IHT404 with form IHT400 to give details of all UK assets the deceased owned jointly with another person.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.