Loading

Get Iceland Rsk 5.43 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iceland RSK 5.43 online

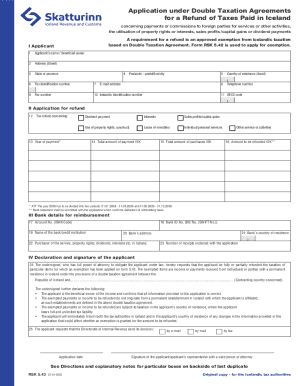

The Iceland RSK 5.43 form is designed to facilitate the application for a refund of taxes paid in Iceland under double taxation agreements. This guide provides clear and user-friendly instructions for each section of the form, ensuring a smooth online filing process.

Follow the steps to complete the Iceland RSK 5.43 form efficiently.

- Press the ‘Get Form’ button to acquire the form and open it for editing.

- In section I, provide the applicant's name or beneficial owner in box 1. Ensure that you enter the full legal name as recognized by tax authorities.

- Next, in box 2, input the complete street address where the applicant resides.

- In box 3, fill in the state or province of the applicant’s residence.

- Enter the postal code and city in box 4.

- In box 5, specify the country of residence for fiscal purposes.

- Input the tax identification number in box 6, ensuring that it is the one assigned by your home country's authorities.

- Provide your email address in box 7 so that you can receive notifications regarding your application.

- Include the telephone number in box 8 for any necessary correspondence.

- If applicable, fill in the fax number in box 9.

- Complete box 10 with the Icelandic identification number if you possess one.

- In box 11, enter the relevant OECD code that corresponds to your legal entity type.

- Proceed to section II and specify the tax refund type in box 12 by selecting the appropriate category (e.g., dividend payment, interest, etc.).

- For box 13, indicate the year in which the payment was made.

- In box 14, record the total amount of payment received in ISK.

- Specify the total amount of taxes paid in box 15.

- Complete box 16 with the amount you are requesting to be refunded in ISK.

- In section III, box 17 requires your bank account number (IBAN) where the refund should be deposited.

- Provide the name of the bank or credit institution in box 19.

- Enter the bank ID number (BIC/SWIFT) in box 18.

- Fill in box 20 with the complete address of your bank.

- In box 21, note the country of your bank’s residence.

- Identify the purchaser of services in box 22.

- Count and record the number of receipts you are enclosing with the application in box 23.

- In section IV, complete box 24 with the name of the contracting country relevant to your application.

- Finally, in box 25, specify how you would like the Directorate of Internal Revenue to send you the decision (by email, mail, or fax). Don't forget to sign the application before submission.

Complete your application for the Iceland RSK 5.43 form online today.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.