Loading

Get Nz Ir330 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NZ IR330 online

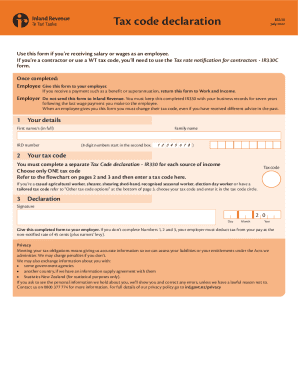

Completing the NZ IR330 form is a vital step for employees to declare their tax code accurately. This guide provides straightforward, step-by-step instructions to help users fill out the form correctly in an online environment.

Follow the steps to accurately complete the NZ IR330 form.

- Click ‘Get Form’ button to obtain the NZ IR330 document and open it in the editor.

- Fill in your personal details in the 'Your details' section, including your first name(s) in full, family name, and IRD number (an 8-digit number starting in the second box).

- In the 'Your tax code' section, select one tax code that applies to your main source of income. Refer to the flowchart provided to determine your correct tax code.

- If you work in specific sectors such as casual agricultural work or as a shearer, enter the relevant tax code listed under 'Other tax code options'.

- Complete the 'Declaration' section by signing and dating the form, ensuring that you have filled in all mandatory fields.

- Once you have filled out the form, you can save any changes, and options will be available to download, print, or share the completed document.

Complete your NZ IR330 form online today to ensure accurate tax withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.