Loading

Get Uk Hmrc Starter Checklist 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC Starter Checklist online

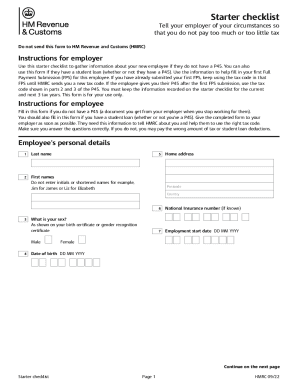

Completing the UK HMRC Starter Checklist online is an essential step for new employees to ensure they pay the correct amount of tax. This guide provides clear, step-by-step instructions to help you accurately fill out the form and communicate your circumstances to your employer.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to download the UK HMRC Starter Checklist and open it for editing.

- Begin by entering your personal details. Provide your last name and first names, ensuring you do not use initials.

- Fill in your home address, including your postcode and country to ensure accurate communication.

- Indicate your sex as stated on your birth certificate or gender recognition certificate by selecting either male or female.

- If known, enter your National Insurance number, as it helps in identifying your tax records.

- Input your employment start date in the format DD MM YYYY to clarify your employment status.

- Proceed to the employee statement section. Answer whether you have another job by marking the appropriate box.

- Indicate if you receive payments from a state, workplace, or private pension by selecting yes or no.

- Respond to the question concerning any taxable benefits received since 6 April, and mark the corresponding statement (A, B, or C).

- If you have a student or postgraduate loan, indicate this. If applicable, answer the follow-up questions regarding your student loan type.

- Complete the declaration section by writing your full name in capital letters, signing, and dating the form in DD MM YYYY format.

- Once the form is finished, give it to your employer promptly for processing. Do not send this form to HM Revenue and Customs.

Start filling out your UK HMRC Starter Checklist online today to ensure your tax details are correctly managed.

A P46 is a form that takes the place of a P45 if you don't have one from a previous employer. It is a tax form that ensures you pay the correct amount of income tax from your pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.