Loading

Get Payroll Report Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payroll Report Sample online

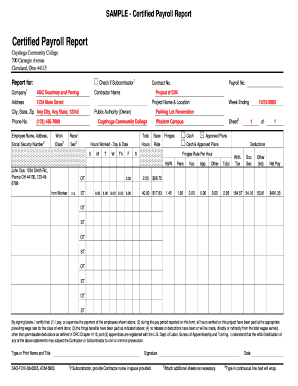

Completing the Payroll Report Sample online is a crucial step in ensuring proper wage reporting and compliance with regulatory requirements. This guide will take you through each section of the report, providing clear instructions for accurate completion.

Follow the steps to complete your payroll report effectively.

- Press the ‘Get Form’ button to access the Payroll Report Sample, allowing you to open it in your online editor.

- In the 'Report for' section, enter the name of the company, including the contractor's name along with their address. This information is critical for identifying who is responsible for the payroll.

- Fill in the 'Project #' and 'Project Name & Location' fields with the applicable details of your work order. Ensure all information accurately reflects the project to avoid discrepancies.

- Provide the public authority name and contact details in the designated section, making certain to include a phone number for any required follow-up.

- In the employee section, list the names, addresses, and Social Security numbers for each person working on the project. Additionally, classify each employee's role or job title.

- Document the hours worked for each employee by day of the week, indicating standard and overtime hours as necessary. Be thorough to ensure all hours are accounted for.

- Input the base pay rate and fringe benefits for each employee in the corresponding fields, ensuring that all financial figures are accurate.

- After completing all sections, review your entries for correctness. Once satisfied, you can save your changes or download, print, or share the completed report.

Complete your Payroll Report Sample online today to ensure timely and accurate wage reporting.

A payroll summary report template is a template that contains detailed information about employees' payments and deductions. It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.