Loading

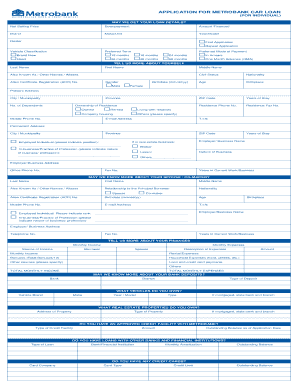

Get Metrobank Car Loan Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Metrobank Car Loan Application Form online

Completing the Metrobank Car Loan Application Form online can streamline your financing process. This guide will provide you with clear, step-by-step instructions on how to accurately fill out each section of the application to enhance your chances of approval.

Follow the steps to effectively complete your application.

- Click ‘Get Form’ button to access the Metrobank Car Loan Application Form and open it in your editor.

- Begin by filling out the loan details section. Input the net selling price, down payment, and amount financed. Specify the brand, make/unit, and year/model of the vehicle. Indicate if this is your first application or a repeat application, and then provide the dealer's information along with the vehicle classification.

- Next, select your preferred loan term by choosing from the available options including 12, 18, 24, 36, 48, or 60 months. Indicate your preferred mode of payment, either in arrears or one month advance.

- In the 'Tell us more about yourself' section, enter your personal information such as your last name, first name, middle name, and any other names or aliases you may have. Fill in your birth date, civil status, nationality, age, and birthplace.

- Complete your contact information, including your residence address, ZIP code, phone and fax numbers, email address, and tax identification number (TIN). Specify how long you have lived at your present address and the number of dependents.

- Include details about your spouse or co-maker, if applicable. Provide their name, relationship to you, nationality, birth date, contact information, and employment details.

- In the 'Tell us more about your finances' section, list your monthly income and expenses. Provide details for both yourself and your spouse, if applicable, and ensure you calculate total monthly income and expenses accurately.

- Disclose any bank deposits you hold by entering your bank and branch details, and type of deposit. Address any vehicles or real estate properties you own, and detail any relevant mortgages or loans.

- Complete the sections on any existing loans or credit facilities with Metrobank and other banks. Specify types of loans, outstanding balances, and monthly amortizations.

- Indicate where you heard about the Metrobank Car Loan. If you are related to anyone in the Metrobank group, provide the necessary details.

- Review the certification statement, ensuring you understand and agree to the terms provided in the form. Sign and date the application accordingly.

- Once all sections are filled out and verified for accuracy, save your changes. You can then download, print, or share the completed form as needed.

Start your application process now by completing the Metrobank Car Loan Application Form online.

Most lenders allow you to submit an application online. You might also have to provide certain documents when you finalize the loan, such as your driver's license and proof of insurance. The loan preapproval process usually involves a hard or soft inquiry on your credit report, depending on the lender's process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.