Loading

Get Amendment Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Amendment Form online

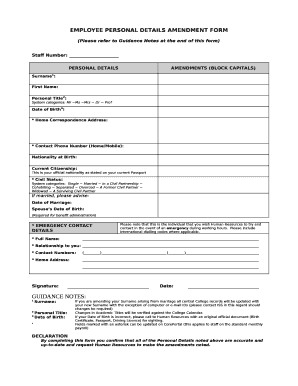

The Amendment Form is designed to update personal details efficiently and effectively. By following this guide, users will learn step-by-step how to complete the form online, ensuring that all necessary information is accurately provided.

Follow the steps to fill out your Amendment Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the personal details section, enter your surname, first name, and personal title using block capitals. Ensure these entries are accurate and clearly spelled.

- Provide your date of birth in the specified format. This information is crucial for identification purposes.

- Fill in your home correspondence address and ensure it is up-to-date and complete. Include all necessary details for accurate communication.

- Enter your primary contact phone number, including home and mobile options. This is important for any future correspondence.

- Indicate your nationality at birth and your current citizenship as stated on your passport. This information helps reflect your legal status.

- Select your civil status from the provided categories. If married, please enter the date of marriage and your spouse's date of birth for benefit administration.

- Provide emergency contact details by entering the full name, relationship to you, and contact numbers. Ensure that the contact can be reached in case of an emergency during working hours.

- Add the home address of your emergency contact. Include any details that may be pertinent for locating them quickly.

- Sign and date the form to confirm that all personal details provided are accurate and up-to-date. Your signature signifies your request for Human Resources to make the necessary amendments.

- Once all fields are completed, save your changes. You can then choose to download, print, or share the completed form as needed.

Complete your Amendment Form online today to ensure your personal details are up-to-date.

Here's a step-by-step guide. Step 1: Collect your documents. Gather your original tax return and any new documents needed to prepare your amended return. ... Step 2: Get the right forms. The IRS form for amending a return is Form 1040-X. ... Step 3: Fill out Form 1040-X. ... Step 4: Submit your amended forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.