Loading

Get Ny Ta-7 822-4 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY TA-7 822-4 online

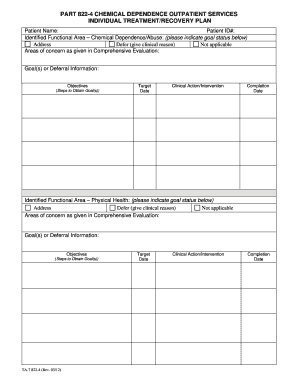

Filling out the NY TA-7 822-4 is essential for creating an individual treatment and recovery plan for individuals seeking chemical dependence outpatient services. This guide provides a step-by-step approach to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete the NY TA-7 822-4 form online.

- Click the ‘Get Form’ button to access the NY TA-7 822-4 form and open it in the online editor.

- Enter the patient's name in the designated field at the top of the form.

- Provide the patient ID number to ensure proper documentation and tracking.

- For each identified functional area, such as chemical dependence, physical health, and mental health, indicate the goal status by selecting the appropriate option (e.g., defer, not applicable) and providing a clinical reason if chosen.

- Fill in areas of concern as identified in the comprehensive evaluation, along with the goals or deferral information related to each area.

- Define specific objectives, which are the steps needed to achieve the outlined goals for each functional area.

- Set target dates for when each objective should be accomplished and detail the clinical actions or interventions that will be implemented.

- Document the completion dates for each clinical action or intervention to keep a clear record of progress.

- After completing all sections of the form, ensure that the required signatures from clinical staff, the patient, parents (if applicable), and any other necessary professionals are included.

- Once all the information is filled in, save any changes, and download or print the completed form for your records or further submission.

Complete your NY TA-7 822-4 form online for a streamlined approach to treatment planning.

You should send your amended tax return to the address specified on the form you are using. The NY TA-7 822-4 can provide specific information on where to direct your submission based on the type of amendment you are filing. Ensuring you send it to the correct location can prevent processing delays.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.