Loading

Get Ny Pfl-1 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY PFL-1 online

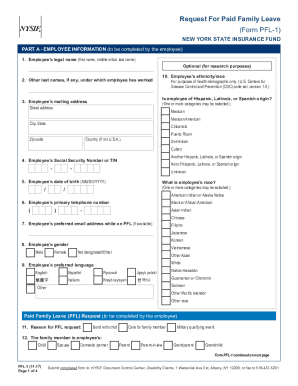

Filling out the New York Paid Family Leave Request Form (PFL-1) is an important step in securing benefits for family leave. This guide provides clear and supportive instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the NY PFL-1 online

- Click ‘Get Form’ button to access the PFL-1 form and open it in your browser.

- Begin by completing Part A of the form, which requires you to enter your personal information including your name, mailing address, date of birth, and average gross weekly wage. Ensure that all required fields are accurately filled out.

- Indicate the reason for your paid family leave request and provide details about the family member with whom you will be bonding or caring for, if applicable.

- For question 12, specify if the leave is continuous or periodic. If periodic, indicate the specific dates you plan to take leave.

- If your submission is made with less than 30 days’ notice, explain why in the provided area or attach a separate document.

- After completing Part A, send the form to your employer for them to fill out Part B, returning it to you within three business days.

- Review the completed form and ensure all information is accurate before submitting it to the New York State Insurance Fund (NYSIF) along with any required supporting documentation.

- Retain a copy of the submitted form and any attachments for your records. Monitor your application status, as NYSIF will notify you of their decision within 18 days.

Complete your forms and submit them online to start your Paid Family Leave request.

No, NY DBL (Disability Benefits Law) benefits are not considered taxable income in New York State. This means you do not need to report these benefits on your tax return. However, if your employer pays for the premiums, the benefits may be taxable. Always check current regulations or consult with a tax advisor to ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.