Loading

Get Sc Sch.tc-18 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC SCH.TC-18 online

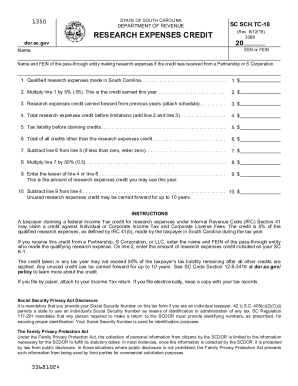

The SC SCH.TC-18 form is used to claim a credit for qualified research expenses incurred in South Carolina. This guide will provide clear, step-by-step instructions to assist you in filling out the form accurately and efficiently online.

Follow the steps to complete your SC SCH.TC-18 form online.

- Click ‘Get Form’ button to obtain the SC SCH.TC-18 form and open it in your preferred editor.

- Start by entering your name and either your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) at the top of the form.

- If you received the credit from a Partnership or S Corporation, provide the name and FEIN of the pass-through entity responsible for the research expenses.

- Enter the total amount of qualified research expenses you incurred in South Carolina on line 1.

- On line 2, calculate your credit earned this year by multiplying the amount reported on line 1 by 5% (0.05).

- If applicable, enter any research expenses credit that you are carrying forward from previous years on line 3.

- Add the amounts from line 2 and line 3 together to get your total research expenses credit before any limitations on line 4.

- Input your tax liability before claiming any credits on line 5.

- On line 6, report the total amount of all credits you are claiming, excluding the research expenses credit.

- Subtract the amount on line 6 from the amount on line 5 on line 7. If this result is less than zero, enter zero.

- Calculate 50% of the amount on line 7 and enter this figure on line 8.

- On line 9, enter the lesser amount between line 4 and line 8. This is the research expenses credit you may apply this year.

- Finally, subtract the amount from line 9 from the total on line 4 and enter this figure on line 10. This is your unused research expenses credit, which can be carried forward for up to 10 years.

- Review all entered information for accuracy, then save your changes. You can choose to download, print, or share the completed form as needed.

Complete your SC SCH.TC-18 form online today!

Classroom Teachers Expenses Credit: Classroom teachers in public or private schools who are not reimbursed by their counties for teaching supplies and materials can claim up to $300 in this refundable credit on their tax year 2022 returns, which are the returns due in 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.