Loading

Get Ca Declaration Of Gross Receipts - City Of Ceres 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Declaration Of Gross Receipts - City Of Ceres online

Filling out the CA Declaration Of Gross Receipts for the City of Ceres online is a straightforward process that helps ensure compliance with local business tax regulations. This guide aims to provide clear, step-by-step instructions for completing each section of the form efficiently.

Follow the steps to complete the online form with ease.

- Click the ‘Get Form’ button to access the CA Declaration Of Gross Receipts form and open it in your preferred editing application.

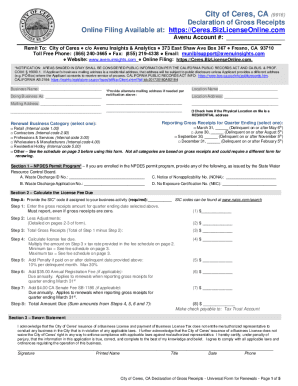

- Input your Avenu Account Number in the designated space. This number is critical for identifying your business in the City of Ceres system.

- Fill in your business name and, if applicable, the Doing Business As (DBA) name. Make sure to double-check spelling for accuracy.

- Provide an alternate mailing address if needed, especially if your business mailing address is a residential one, as this may be subject to public disclosure.

- Select the reporting gross receipts for the appropriate quarter ending date. Choose from March 31, June 30, September 30, or December 31.

- Identify your business category by selecting from the options provided, such as Retail, Contractors, Professions & Services, or others. Ensure that you refer to the fee schedule if unsure.

- Complete Section 1 for the NPDES Permit Program if applicable. Provide the Waste Discharge ID number, Waste Discharge Application number, Notice of Nonapplicability number, or No Exposure Certification number as required.

- In Section 2, begin with Step 1 by entering your gross receipts amount for the quarter selected. It is essential to report this even if the amount is zero.

- Proceed to Step 2 and enter any adjustments to your gross receipts, as outlined on pages 2-3 of the form.

- Calculate the total gross receipts in Step 3 by subtracting adjustments from the gross receipts reported.

- Determine the license fee due in Step 4 by multiplying the total gross receipts by the tax rate provided in the fee schedule.

- Step 5 involves adding any penalties if payment is made after the delinquent date specified.

- If applicable, add the annual registration fee in Step 6 for renewals that report gross receipts for the quarter ending March 31.

- Add the California Senate fee as per Step 7 if applicable to your case.

- Finally, calculate the total amount due in Step 8 by summing the amounts from all previous steps to ensure you have an accurate total.

- Sign and date the sworn statement at the bottom of the form, ensuring that all information provided is true and complete.

- After completing all sections, save your changes, and consider downloading, printing, or sharing the completed form as necessary.

Complete the CA Declaration Of Gross Receipts - City Of Ceres online today to ensure your business remains compliant with local regulations.

Portland, Oregon, and Anchorage, Alaska, have no state or local sales taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.