Loading

Get Uk Vat 1 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

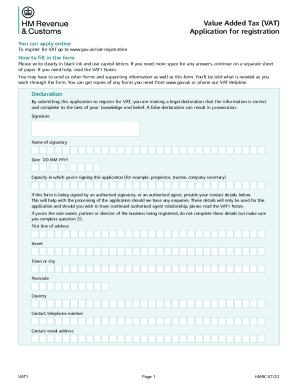

How to fill out the UK VAT 1 online

Filling out the UK VAT 1 form for VAT registration is a crucial step for businesses in the UK. This guide provides a clear and supportive walkthrough to help users complete the application accurately and efficiently.

Follow the steps to complete your VAT 1 application online.

- Click ‘Get Form’ button to obtain the UK VAT 1 form and open it in the editor.

- Begin by providing general information about your business. Indicate whether it is a UK business or a non-established business in the UK by placing an ‘X’ in the appropriate box.

- Enter the type of business you are registering. Complete only one section that pertains to your business type, such as sole trader, partnership, or corporate body. Make sure to provide all required details.

- Fill in the business contact details, ensuring to include a valid address where your business operates. Preferably, this should be a UK address and not a PO box.

- Specify the reason for VAT registration. Select only one reason by marking an ‘X’ in the corresponding box. Be mindful of the specific requirements for your chosen reason.

- Estimate your taxable supplies for the next 12 months by entering the approximate financial figures. You will also need to specify any exempt supplies you expect to make.

- Complete any sections relevant to your business activities. Provide detailed descriptions of primary activities and any supplementary information as required.

- Fill in your UK bank or building society account details, ensuring the account is held in the name of the business. This information is crucial for processing payments.

- Review the applicant details, ensuring that the person completing the form has the authority to do so. Include all relevant personal information and references.

- Once you have completed all necessary sections, save your changes. You can then download, print, or share the form as needed.

Start your VAT registration process by completing the VAT 1 form online today.

You can usually register for VAT online. You need a Government Gateway user ID and password to register for VAT . If you do not already have a user ID you can create one when you sign in for the first time. Registering for VAT also creates a VAT online account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.