Loading

Get Ca Ftb 3571 C2 2006-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3571 C2 online

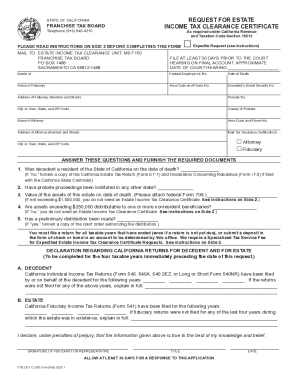

The CA FTB 3571 C2 is a crucial form for obtaining an estate income tax clearance certificate from the California Franchise Tax Board. Filling it out correctly ensures compliance with tax regulations, facilitating a smoother probate process.

Follow the steps to complete your CA FTB 3571 C2 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin by entering the estate's name in the designated field.

- Provide the Federal Employer Identification Number (FEIN) associated with the estate.

- Enter the date of death of the decedent to establish the timeline.

- Fill in the name of the fiduciary responsible for managing the estate.

- Add the area code and phone number of the fiduciary for contact purposes.

- Input the decedent's Social Security number as required.

- Complete the address of the fiduciary, including the number, street, city or town, state, and ZIP code.

- Record the probate number relating to the estate.

- Indicate the county where the probate is being processed.

- Enter the name of the attorney handling the legal matters of the estate.

- Add the attorney's area code and phone number.

- Complete the attorney's address, including number, street, city or town, state, and ZIP code.

- Choose whether to mail the Tax Clearance Certificate to the attorney or fiduciary by marking the appropriate box.

- Answer the questions regarding residency, probate proceedings, asset value, and distributions, providing required documentation as instructed.

- Complete the declaration section for the decedent for the last four years, mentioning which tax returns were filed.

- Complete the declaration section for the estate, confirming the filing of fiduciary returns for the necessary years.

- Sign and date the form as the fiduciary or representative; ensure all information is accurate.

- After completing the form, save your changes, and consider downloading, printing, or sharing the document as needed.

Complete your CA FTB 3571 C2 form online to ensure timely processing.

How long is my Tennessee sales tax exemption certificate good for? All blanket exemption certificates are infinitely valid, so long as there is recurring purchases by the owner of the certificate, where no more than one year passes between sales, or until the buyer cancels the certificate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.