Loading

Get Penalty Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Penalty Form online

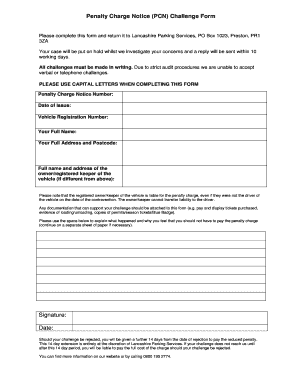

Completing the Penalty Form online is a straightforward process that allows you to challenge a penalty charge notice effectively. Follow the steps below to ensure you fill out the form accurately and submit it correctly.

Follow the steps to fill out the Penalty Form online

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- Enter your penalty charge notice number in the designated field. This number is essential for identifying your case.

- Fill in the date of issue for the penalty charge notice. This information can usually be found on the notice itself.

- Provide your vehicle registration number. Ensure this is accurate to avoid any delays in processing your challenge.

- Input your full name in the corresponding field. Make sure to use capital letters as specified in the instructions.

- Complete your full address and postcode. This helps identify your location for correspondence.

- If the registered owner of the vehicle differs from you, provide their full name and address in the respective section.

- In the provided space, explain the circumstances surrounding the penalty charge and why you believe it should be revoked. You may continue on a separate sheet if necessary.

- Attach any supporting documentation that substantiates your challenge, such as pay and display tickets or permits.

- Sign and date the form before finalizing your submission.

- Once all information is completed, you can save the changes, download, print, or share the form as needed.

Complete your documents online today for a smooth submission process.

You can file an appeal if all the following have occurred: You received a letter that the IRS assessed a failure to file and/or failure to pay penalty to your individual or business tax account. You sent a written request to the IRS asking them to remove the penalty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.