Loading

Get Fl Mark Cross Tax Services Tax Return Drop Off Sheet 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL Mark Cross Tax Services Tax Return Drop Off Sheet online

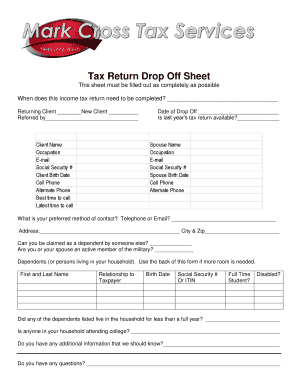

Completing the FL Mark Cross Tax Services Tax Return Drop Off Sheet online is essential for efficient tax preparation. This guide provides clear, step-by-step instructions to help you fill out the necessary fields accurately and completely.

Follow the steps to fill out the tax return drop off sheet online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by indicating whether you are a returning client or a new client by selecting the appropriate checkbox.

- Fill in your personal information including client name, occupation, email, social security number, birth date, cell phone, and alternate phone.

- Specify the best time and latest time to call you, followed by the date you are dropping off the form.

- Indicate whether last year’s tax return is available.

- If applicable, provide your spouse’s information in the designated fields, including name, occupation, email, social security number, birth date, cell phone, and alternate phone.

- Choose your preferred method of contact, either telephone or email, and complete your address information.

- Indicate if you can be claimed as a dependent by someone else and whether you or your spouse is an active member of the military.

- List all dependents (or persons living in your household) and fill out their details including names, relationships to taxpayer, birth dates, social security numbers or ITINs, and whether they are full-time students or disabled.

- Indicate whether any dependents lived in the household for less than a full year and if anyone attends college.

- Provide any additional information that may be relevant and write any questions you may have.

- In the document checklist, check all applicable income sources and include relevant documents if available.

- Move to the expenses section, checking all applicable expenses and attaching documents as necessary.

- Review the credits & deductions section, checking any applicable contributions and expenses related to your or your spouse's financial situation.

- Lastly, check any miscellaneous items that apply and ensure you leave all relevant financial documents for a thorough assessment.

- Confirm you have reviewed and signed the consent forms at the end of the document, adding your signature and the date.

- After filling out the form completely, save your changes, and prepare to download, print, or share it as needed.

Start completing the FL Mark Cross Tax Services Tax Return Drop Off Sheet online today!

Enter the amount using all numbers ($###.##). Do not use staples or paper clips to affix your payment to your voucher or return. Make sure your check or money order includes the following information: Your name and address.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.