Loading

Get Pr 480.6c 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 480.6C online

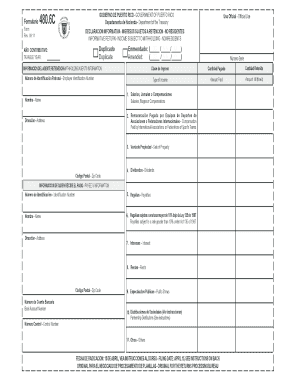

Filling out the PR 480.6C form online is an essential task for nonresidents who have income subject to withholding in Puerto Rico. This guide will provide clear and comprehensive instructions to help you complete the form accurately.

Follow the steps to fill out the PR 480.6C online.

- Press the ‘Get Form’ button to access the PR 480.6C online form and open it in your editor.

- Enter the taxable year in the provided section for 'Año Contributivo' (Taxable Year). This should be the year for which you are reporting income.

- Fill in the withholding agent's information, including the Employer Identification Number (Número de Identificación Patronal), amount paid (Cantidad Pagada), and amount withheld (Cantidad Retenida) for the various income types listed.

- In the section for types of income, check the corresponding box for each income category that applies to the payee, such as salaries, dividends, royalties, or property sale.

- Ensure all information is accurate and double-check each entry for completeness.

Complete your PR 480.6C form online today to ensure all your income reporting is up to date.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In some cases, your forgiven debt is taxable – and in some it's not. When it is taxable nonbusiness debt, you'll use the copy of the 1099-C to use to report it on Schedule 1 of Form 1040 as other income.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.