Get Nj Notification Of Licensed Public Accountant 2001-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ Notification of Licensed Public Accountant online

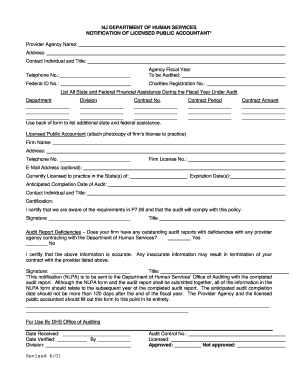

Completing the NJ Notification of Licensed Public Accountant is essential for ensuring compliance with auditing requirements for provider agencies. This guide provides step-by-step instructions to help you fill out the form accurately and efficiently.

Follow the steps to complete your form correctly

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the provider agency name in the designated field. This should reflect the official name of your organization.

- Fill in the address of the provider agency, including street address, city, state, and zip code.

- Provide the contact individual's name and their title within the organization to ensure the correct point of contact.

- Include the telephone number of the contact individual to facilitate communication during the auditing process.

- Specify the agency fiscal year that will be audited, ensuring that it aligns with your accounting records.

- Input the federal ID number assigned to your agency for identification purposes.

- Enter the Charities Registration number if applicable, which helps to verify the legitimacy of your agency.

- List all state and federal financial assistance received during the fiscal year under audit. Utilize the space provided and the back of the form if needed.

- Fill in the contract period, including start and end dates, to define the scope of the audit.

- Specify the contract amounts corresponding to each listed assistance to provide a clear financial overview.

- List the Licensed Public Accountant information, including the firm name, address, telephone number, and license number. Ensure to attach a photocopy of the firm’s license.

- Optionally, provide the email address of the firm for follow-up communications.

- Indicate the states in which the accountant is currently licensed to practice.

- Enter the expiration date(s) of the accountant’s license to ensure compliance.

- Set the anticipated completion date of the audit, keeping in mind the requirements that it not exceed 120 days post fiscal year-end.

- Input the name and title of the contact individual associated with the accountant firm.

- Review and sign the certification statement, confirming awareness of audit requirements and agreeing to compliance.

- Indicate if there are any audit report deficiencies by selecting ‘Yes’ or ‘No’. Provide additional information if necessary.

- Finally, certify the accuracy of the information provided by signing and including your title. Ensure all information is correct to prevent any issues with contract approval.

Complete the NJ Notification of Licensed Public Accountant online to ensure timely compliance with auditing requirements.

A public accountant is a professional who provides accounting services to a variety of clients, including individuals, businesses, and government entities. They can hold various certifications, with the CPA designation being the most recognized. If you are aiming to become a public accountant in New Jersey, obtaining your NJ Notification of Licensed Public Accountant is crucial for your practice.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.