Loading

Get Ne Form 16875 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE Form 16875 online

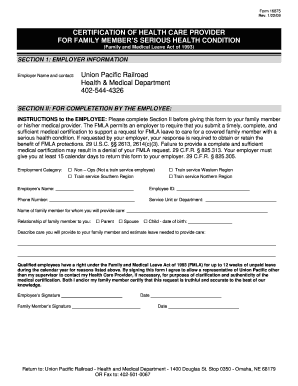

This guide provides a clear and concise overview of how to complete the NE Form 16875 online, a certification of health care provider for a family member’s serious health condition. Following these steps will help ensure a smooth process for both the employee and health care provider involved.

Follow the steps to fill out the NE Form 16875 online

- Click the ‘Get Form’ button to access the NE Form 16875 and open it in your chosen online editor.

- Begin by filling out Section I, which requires employer information. Input the employer's name and contact details accurately.

- Proceed to Section II. Here, the employee must provide their employment category, name, employee ID, phone number, service unit or department, and the name and relationship of the family member receiving care.

- In Section II, describe the care to be provided and estimate the leave needed for the family member. Ensure this information is detailed to avoid any misunderstandings.

- Both the employee and family member need to sign and date the agreement in Section II, confirming the accuracy of the request.

- Advance to Section III to be completed by the health care provider. Provide the healthcare provider's name, business address, type of practice, phone number, and fax number.

- In Section III, the health care provider must answer all pertinent medical questions fully and accurately. This includes the start date of the condition, treatment dates, and information about hospital stays if applicable.

- The health care provider must also describe the amount of care needed, providing estimates for any incapacity due to the medical condition and detailing why such care is necessary.

- After completing all sections, review the form for accuracy before finalizing.

- Finally, save the document. You may choose to download, print, or share the completed form as necessary.

Ensure your family's health needs are met by completing the NE Form 16875 online today.

To fill out an assessment form, start by ensuring you have all necessary information, such as your contact details and the purpose of the assessment. Next, carefully follow guidelines in the NE Form 16875 to answer specific questions accurately. Review your responses to ensure completeness before submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.