Loading

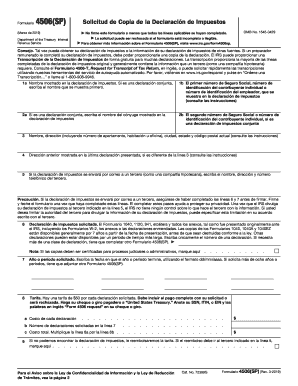

Get Form 4506 (sp) (rev. 3-2019). Request For Copy Of Tax Return (spanish Version)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4506 (SP) (Rev. 3-2019). Request for copy of tax return (Spanish version) online

Filling out Form 4506 (SP), a request for a copy of your tax return in Spanish, is a straightforward process that allows you to obtain copies of your tax records. This guide provides a clear, step-by-step approach to help you fill out the form accurately online.

Follow the steps to easily fill out the Form 4506 (SP) online.

- To start, press the ‘Get Form’ button to access the Form 4506 (SP) and open it in your chosen editor.

- In line 1a, enter the name as displayed on your tax return. If filing a joint return, provide the name of the first filer.

- If applicable, in line 2a, enter the spouse's name as shown on the tax return, and in line 2b, provide the second SSN or ITIN if it's a joint return.

- In line 3, fill in your current name and address, including apartment or suite numbers, city, state, and ZIP code.

- Line 4 requires you to report the address on your last filed return if it differs from your current address in line 3.

- If you wish the tax return to be sent to a third party (such as a mortgage company), provide their name, address, and phone number in line 5.

- In line 6, indicate the type of tax return you are requesting, such as Form 1040 or 1120, along with any attached schedules, as originally filed with the IRS. Note that you can only request one type of return per form.

- In line 7, indicate the tax year or period by writing the end date in the dd/mm/yyyy format. If you require copies for more than eight years, attach an additional Form 4506 (SP).

- For line 8, include the required payment of $50 for each tax return requested. Ensure your payment is made out to 'United States Treasury' and note your SSN, ITIN, or EIN with the phrase 'Form 4506 request' on your payment.

- Complete line 9 by indicating if you require a refund for any missed tax returns and specify if the refund should go to the third party listed in line 5.

- Finally, sign and date the form in the designated area, confirming that all applicable lines have been completed. Ensure the form is sent to the appropriate address as specified in the form's instructions.

Take the time to fill out your tax return request form online today for a quicker and easier process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Use Form 4506 to request a copy of your tax return. You can also designate (on line 5) a third party to receive the tax return. How long will it take? It may take up to 75 calendar days for us to process your request.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.