Loading

Get Form No 26a Form For Furnishing Accountant Certificate - Incometaxindia Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM No 26A Form For Furnishing Accountant Certificate - Incometaxindia Gov online

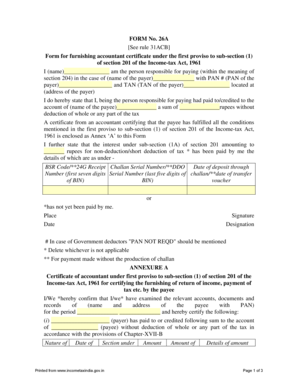

Filling out the FORM No 26A for providing an accountant certificate is an essential step for compliance with the Income-tax Act, 1961. This guide will help you navigate through the necessary sections of the form in a clear and user-friendly manner.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- In the first section, enter your full name as the person responsible for paying. Additionally, provide the name, PAN, and TAN of the payer, along with their address. Make sure all details are accurate to avoid complications.

- State the amount paid or credited to the payee's account. Specify that this payment was made without any tax deduction.

- Attach a certificate from an accountant stating that the payee has met all the necessary conditions. This certificate should serve as Annex ‘A’ to the form.

- If applicable, indicate the interest amount due for any non-deduction or short deduction of tax, along with the required payment details: BSR Code, receipt challan serial number, date, and mode of deposit.

- In the annexure section, the accountant must confirm the examination of relevant records for the payee. Complete all required fields, including payment amounts and the nature of transactions.

- Ensure that all fields and information provided in the form and attached annexures are accurate. Review for completeness and correctness before final submission.

- Once you have verified all details, you can save the changes, download the form, print it, or share it as necessary.

Complete your FORM No 26A online now to ensure compliance with the Income-tax regulations.

Visit the government's e-filing website https://incometaxindiaefiling.gov.in. Sign in to the account using the login credentials you registered to file your ITR (username, PAN Card, password) Click on the "My Accounts" tab or the "Quick links" tab. Select the option to view Form 26AS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.