Loading

Get Or Challenge To Garnishment - County Of Washington 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR Challenge To Garnishment - County Of Washington online

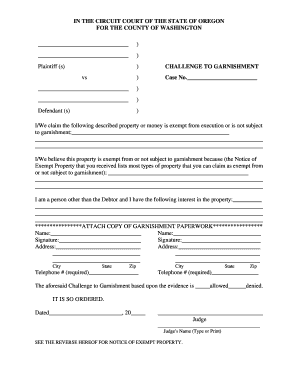

The OR Challenge To Garnishment form allows individuals to contest the garnishment of their property or funds. This guide provides comprehensive, step-by-step instructions to assist you in correctly completing this form online, ensuring that your rights are protected.

Follow the steps to complete the online form accurately and efficiently.

- Click the ‘Get Form’ button to access the Challenge To Garnishment form. This will allow you to open the document in an online editor for completion.

- Begin by filling in the names of the plaintiff(s) and defendant(s) at the top of the form. Make sure to accurately reflect the case names as they appear on your court documents.

- In the designated area, provide a clear description of the property or money you claim is exempt from garnishment. Be specific about what is being claimed.

- Next, explain the reason why you believe this property is exempt or not subject to garnishment. Reference any notices you have received regarding exempt property.

- If you are not the debtor, indicate your relationship to the property and any interest you may have in it. Clearly outline your position to avoid confusion.

- Attach a copy of the garnishment paperwork as instructed in the form. This is essential to validate your challenge and process your claim.

- Complete all required fields, including your name, address, and telephone number. Ensure that the information is accurate to facilitate communication.

- Sign and date the form where indicated. If multiple parties are involved, ensure that all necessary signatures are collected.

- Review the completed form for accuracy and completeness. Make any necessary corrections before finalizing your submission.

- Once verified, you can save changes, download, print, or share the form as needed. Follow the protocols for submitting it to the court.

Complete your Challenge To Garnishment form online today to protect your rights and assert your exemptions.

Disposable earnings are calculated similar to a writ of garnishment. Withholding from disposable earnings continues until the 60-day period is up, the amount is paid in full, the writ is released in writing, or the agency no longer holds any earnings payable to the individual.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.