Loading

Get Az Fuel Delivery Form 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ Fuel Delivery Form online

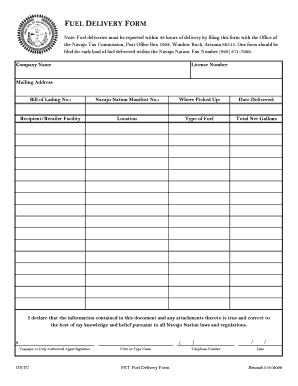

Navigating the AZ Fuel Delivery Form online can be straightforward with the right guidance. This comprehensive guide will help you fill out the necessary fields accurately and efficiently, ensuring compliance with the requirements set by the Navajo Tax Commission.

Follow the steps to complete the AZ Fuel Delivery Form online.

- Click ‘Get Form’ button to obtain the AZ Fuel Delivery Form and open it in your online document editor.

- Provide your company's name in the designated field to identify the entity requesting fuel delivery.

- Enter your license number, ensuring that it accurately reflects your business credentials.

- Fill in your complete mailing address to ensure that correspondence reaches you without issues.

- Record the Bill of Lading number in the appropriate section, which serves as proof of shipment.

- Input the Navajo Nation Manifest number to comply with local regulatory requirements.

- Specify the location where the fuel was picked up to provide geographical clarity.

- Indicate the date the fuel was delivered to maintain accurate records.

- Fill in the recipient or retailer facility location, which is necessary for delivery verification.

- Select the type of fuel being delivered to correctly categorize the transaction.

- Enter the total net gallons delivered to ensure accurate accounting for the transaction.

- In the declaration section, affirm that the information provided is truthful to the best of your knowledge, and then sign the document.

- Print or type your name as the taxpayer or duly authorized agent under the signature line.

- Provide your telephone number for any potential follow-up regarding your submission.

- Lastly, enter the date of completion to finalize the document.

- Once all necessary fields are filled, save your changes, and choose to download, print, or share the completed form as needed.

Complete your AZ Fuel Delivery Form online today to ensure timely filing and compliance.

California has the highest tax rate on gasoline in the United States. As of March 2022, the gas tax in California amounted to 68 U.S. cents per gallon, compared with a total gas price of 5.79 U.S. dollars per gallon. Meanwhile, Alaska had the lowest gas tax out of all U.S. states, at 14 U.S. cents in 2021.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.