Loading

Get Jm Form 4d 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the JM Form 4D online

Filling out the JM Form 4D online is an essential step for businesses engaged in tourism activities in Jamaica. This guide will provide you with clear, step-by-step instructions to effectively complete the form and ensure compliance with tax regulations.

Follow the steps to fill out the JM Form 4D online:

- Click the ‘Get Form’ button to access the JM Form 4D online and open it in your preferred editor.

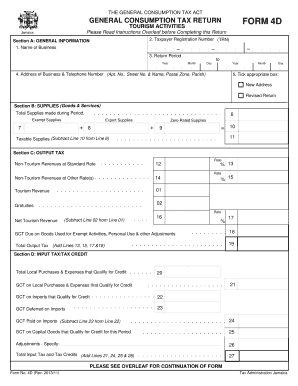

- In Section A: General Information, provide the name of your business in the appropriate field and enter your Taxpayer Registration Number (TRN), ensuring accuracy as per your registration certificate.

- Specify the return period by entering the year, month, and day of the start and end dates for the reporting period.

- Fill in the address of your business, including apartment number, street number and name, postal zone, and parish, along with a contact telephone number.

- For Section A, tick the appropriate box if the address is new or if the return is a revised return.

- In Section B: Supplies, provide the total amount for supplies made during the return period, distinguishing between exempt supplies and taxable supplies.

- In Section C: Output Tax, input the applicable rates for non-tourism revenues and report taxable tourism revenue separately.

- Next, you will fill out Section D: Input Tax/Tax Credit by reporting total local purchases and expenses that qualify for credit.

- Proceed to Section E: GCT Payable / Creditable, where you will calculate GCT payable or creditable based on the inputs from previous sections.

- Finally, review all entries for accuracy, then save changes, download, print, or share the completed form as needed.

Complete the JM Form 4D online today to ensure your compliance with tax requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In general, Jamaican residents and domiciled individuals are taxed on their worldwide income, while non-resident individuals are taxed on Jamaican-sourced income. A non-Jamaican domiciled individual is generally not taxable on foreign-sourced income unless one remits this to Jamaica.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.