Loading

Get Ma Phm-2 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA PHM-2 online

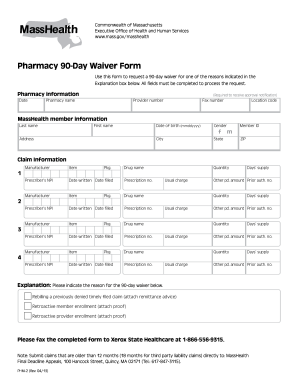

The MA PHM-2 form is essential for requesting a 90-day waiver for specific pharmacy-related reasons in Massachusetts. This guide will provide clear, step-by-step instructions for completing the form online to ensure a smooth submission process.

Follow the steps to complete the MA PHM-2 form online.

- Press the ‘Get Form’ button to access the form, which will open it in your online editing tool.

- Begin with the pharmacy information section. Fill in the date required to receive approval notification, then provide the pharmacy name, provider number, fax number, and location code.

- Proceed to the MassHealth member information section. Enter the last name, first name, date of birth (in mmddyyyy format), gender, address, city, state, ZIP, and the member ID.

- Move to the claim information section. Here, you will need to enter details for up to four prescriptions. For each entry, provide the manufacturer, item, package size, drug name, prescriber’s NPI, the date written, date filled, prescription number, quantity, days’ supply, usual charge, other paid amount, and prior authorization number.

- In the explanation box, select the reason for requesting the 90-day waiver. Choose from rebilling a previously denied timely filed claim, retroactive member enrollment, or retroactive provider enrollment and attach the required documentation if applicable.

- After verifying all fields are complete and accurate, you can save changes, download the form, print it, or share it as needed. When ready, submit the completed form by fax to Xerox State Healthcare at 1-866-556-9315.

Complete your MA PHM-2 form online today for an efficient submission process.

Yes, PFML is considered taxable income. Both the IRS and the Massachusetts Department of Revenue treat these benefits as taxable. When filing using the MA PHM-2, ensure you include all income received from PFML in your total taxable income. Accurate reporting will facilitate smooth processing of your returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.