Loading

Get Form Va 5 Quarterly

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Va 5 Quarterly online

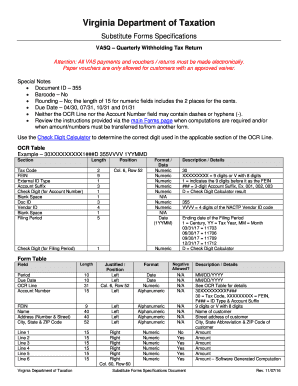

This guide will help you complete the Form Va 5 Quarterly, an important document for reporting Virginia income tax withheld. By following these instructions, you can efficiently fill out the form online with confidence.

Follow the steps to fill out the Form Va 5 Quarterly online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your FEIN in the designated field. This is a 9-digit number that identifies your business. Ensure there are no dashes or hyphens.

- Provide your business name, including all necessary abbreviations in the name field, limited to 40 characters.

- Fill in your address, including number and street, which should also be limited to 40 characters.

- Complete the city, state, and ZIP code fields. Use an accurate two-letter state abbreviation.

- In the amount fields, report the Virginia income tax withheld and any adjustments. Carefully follow the instructions for adjustments as needed.

- Complete section regarding penalties and interest if applicable. Follow the detailed instructions provided for these calculations.

- After verifying all entries for accuracy, you can save changes to your form, download, print, or share it as needed.

Complete your Form Va 5 Quarterly online to ensure timely and accurate reporting.

Yes. You MUST file Form VA-4P with your pension or annuity payer before your payments begin. If you do not file Form VA-4P, your payer is required to withhold Virginia income tax from your payments as if you had claimed zero exemptions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.