Loading

Get Nc Nc-br 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC NC-BR online

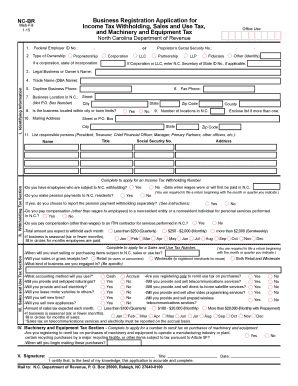

The NC NC-BR form is essential for registering a business for income tax withholding, sales and use tax, and machinery and equipment tax in North Carolina. This guide provides step-by-step instructions to assist users in filling out the form accurately and efficiently online.

Follow the steps to complete the NC NC-BR form online.

- Click ‘Get Form’ button to obtain the NC NC-BR form and open it in the digital editor.

- Complete Section I, Identifying Information. Enter your Federal Employer Identification Number (FEIN), or if you have applied for it, state 'applied for' and provide it later. For a sole proprietorship, use the owner's Social Security Number.

- In line 3, provide the legal business name for corporations or LLCs as per the Articles of Incorporation or Organization. For partnerships, list the legal name of the partnership.

- Enter the trade name (doing business as) in line 4.

- For line 7, input the business's physical location in North Carolina. Do not use a P.O. Box.

- If applicable, complete Section II to apply for an Income Tax Withholding Number. Indicate if you have employees subject to withholding.

- Proceed to Section III if registering for a Sales and Use Tax Number. State when sales will begin and the nature of your business.

- Complete Section IV if you need to remit tax on machinery and equipment purchases.

- Once all sections are filled out, sign the application in Section V. Ensure the signature is from an authorized individual.

- After verifying all entries, save changes. You can download, print, or share the completed form as needed.

Take action now and complete your NC NC-BR form online with confidence.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Mailing an Application to Reserve a Business Entity Name to the North Carolina Department of the Secretary of State along with the $30 filing fee. Or, by filling the form out online.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.