Loading

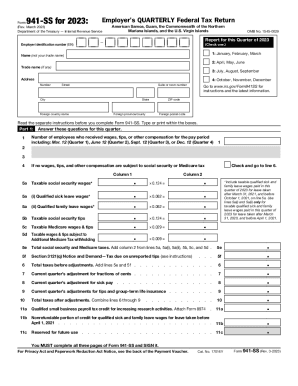

Get Irs 941-ss 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 941-SS online

Filling out the IRS 941-SS online can seem daunting, but with clear guidance, you can navigate this essential form with ease. This guide provides step-by-step instructions to help you complete your quarterly federal tax return accurately and efficiently.

Follow the steps to complete the IRS 941-SS form online.

- Click ‘Get Form’ button to download the form and open it for completion.

- Enter your employer identification number (EIN) in the designated section at the top of the form. This unique number is necessary for filing your taxes correctly.

- In Part 1, record the number of employees who received wages, tips, or other compensation during the quarter.

- Continue to report any current adjustments and credits in the designated sections, ensuring accurate totals.

- In Part 2, indicate your deposit schedule to inform the IRS of your Tax Liability for each month.

- Provide information about your business and finalize it by signing the form, ensuring all three pages are marked appropriately.

- Once completed, you can save your changes, download, print, or share the IRS 941-SS form as needed.

Start completing your IRS 941-SS form online today for a smooth filing process.

Call 800-829-3676.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.