Loading

Get Good Faith Estimate Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Good Faith Estimate Of online

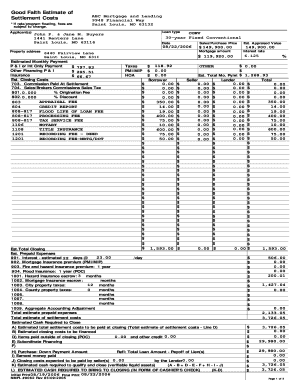

The Good Faith Estimate Of is a vital document that outlines the expected costs associated with a mortgage, helping users to understand their potential financial commitments. This guide will provide clear, step-by-step instructions on how to accurately fill out the form online, ensuring that you provide all necessary information effectively.

Follow the steps to accurately complete the Good Faith Estimate Of form.

- Press the ‘Get Form’ button to obtain the Good Faith Estimate Of form and open it in your preferred editor.

- Begin by entering the applicant's name(s) in the designated field. This section typically includes the full legal names of all individuals applying for the mortgage.

- Fill in the property address where the mortgage will be applied. Be sure to include the complete address, including city and state.

- Next, indicate the sales or purchase price of the property, ensuring that the amount is accurately reflected in dollar format.

- Enter the mortgage amount that you are requesting. This should not exceed the purchase price unless you are including additional financing.

- Specify the loan type selected for this mortgage. For example, you may choose options like fixed rate or adjustable rate.

- Provide information on estimated monthly payments, including principal and interest, along with any other potential monthly costs such as insurance.

- List the various estimated closing costs associated with the mortgage under the appropriate sections, ensuring to include any fees such as appraisal fees, credit report costs, and title insurance.

- Calculate the total estimated cash needed to bring to closing. This includes deductions for any earnest money already paid and other credits.

- Review all entered information for accuracy. Ensure that every field is accurately filled and values are correctly calculated.

- Once you have confirmed that the form is complete and correct, you can save the changes, download the document, print it, or share it as needed.

Complete your Good Faith Estimate Of online now for a seamless mortgage experience.

An analysis of new research suggests that, contrary to the views of some observers, the Good Faith Estimate disclosure has been an accurate predictor of actual mortgage closing costs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.