Loading

Get Council Tax Change Of Address Moving / Selling A Property Within Fife ... - Publications 1fife Org

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Council Tax Change Of Address Moving / Selling A Property Within Fife online

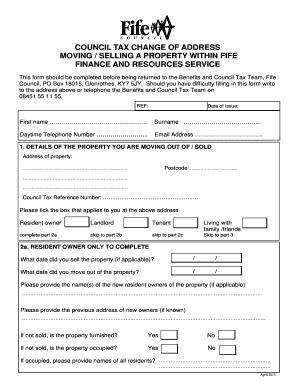

This guide provides clear and supportive instructions on how to fill out the Council Tax Change Of Address form when moving or selling a property within Fife. Follow these steps to ensure a smooth and accurate completion of the document.

Follow the steps to successfully complete the form

- Press the ‘Get Form’ button to obtain the Council Tax Change Of Address form. This allows you to access the document online for completion.

- Begin by entering your first name, surname, daytime telephone number, and email address in the designated fields.

- In section 1, provide the address of the property you are moving out of or have sold, including the postcode. Fill in your Council Tax reference number and indicate your status at the previous address (e.g., resident owner, landlord, tenant, etc.).

- If you are a resident owner, complete part 2a by entering the sale date and move-out date of the property. Specify the names and previous addresses of new resident owners if applicable. Answer whether the property is furnished and occupied.

- For landlords, fill out section 2b with the sale date, details on furnishings, occupancy, and tenant information. Include the tenancy start and end dates.

- As a tenant, complete section 2c by entering tenancy dates, furnishing details, and landlord or agency information.

- In section 3, provide details about the new property you are moving into or buying, including the address and postcode. Again, specify your relationship to this property.

- For resident owners in section 3a, note the move-in date, purchase date, and prior ownership details. Include the names of occupants aged 18 or over at your new address.

- In section 4, indicate if you are the sole occupant and apply for any applicable discounts or exemptions based on your circumstances.

- Section 5 allows for Council Tax reduction applications if you have a low income. Specify whether you require an application form.

- In section 6, state how you prefer to pay your Council Tax and provide necessary details if you select direct debit.

- Include any additional information in section 7 and sign the declaration. Ensure all information is accurate to avoid any penalties.

- At the end of the form, you can save changes, download a copy, or print it for your records, making sure to return it to the Benefits and Council Tax Team.

To ensure your Council Tax records are up to date, complete the form online now.

Perth & Kinross Council has increased Council Tax in 2023/24 (excluding Water and Wastewater charges set by Scottish Water) by 3.9% which has funded priorities in line with its corporate plan and strategic objectives.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.