Loading

Get Ms Dor Form 80-110 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS DoR Form 80-110 online

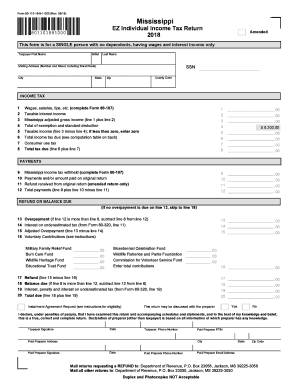

Filling out the MS DoR Form 80-110 online can be straightforward when you understand the necessary steps and information required. This guide provides a clear roadmap to help you accurately complete your EZ Individual Income Tax Return for Mississippi.

Follow the steps to successfully complete and submit your form.

- Click the 'Get Form' button to obtain the form and open it in your preferred editor.

- Enter your taxpayer first name, initial, and last name in the respective fields provided on the form. Make sure all names are spelled correctly.

- Input your social security number (SSN) accurately to avoid any errors.

- Fill in your mailing address, ensuring to include street number and name, city, state, county code, and ZIP code.

- In section titled 'Income Tax,' begin by completing line 1 with the total of your wages, salaries, tips, and other compensation.

- Next, enter any taxable interest income you have received on line 2.

- Calculate your Mississippi adjusted gross income on line 3 by adding the amounts from line 1 and line 2 together.

- On line 4, list the total of exemptions and standard deductions applicable to your situation.

- Compute your taxable income on line 5 by subtracting line 4 from line 3. If the result is below zero, enter zero.

- Follow the tax computation table instructions to calculate the total income tax due on line 6, based on your taxable income.

- Fill in any consumer use tax amount owed on line 7, if applicable.

- Add the total income tax due from line 6 and the consumer use tax from line 7 to get the total tax due on line 8.

- Record Mississippi income tax withheld from line 9 based on your withholding tax schedule.

- For amended returns, enter the payments made or paid on the original return in line 10.

- Indicate any refund received from the original return, specifically if this is an amended return, on line 11.

- Calculate total payments for line 12 by adding line 9 and line 10, then subtracting line 11.

- If applicable, calculate any overpayment on line 13 and proceed to lines 14-20 as specified for your situation.

- At the conclusion, review your entries and save any changes. You can then download, print, or share the completed form as needed.

Start completing your MS DoR Form 80-110 online today for a seamless filing experience.

The Internal Revenue Service (IRS) administers and enforces U.S. federal tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.