Loading

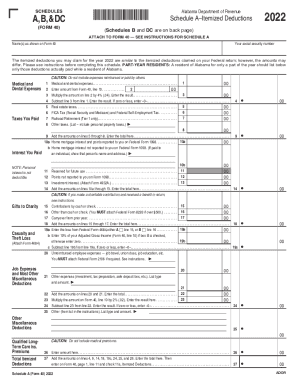

Get Al Schedules A B &dc Form 40 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL Schedules A B & DC Form 40 online

Filling out the AL Schedules A B & DC Form 40 online can seem daunting, but this guide provides a clear, step-by-step approach to assist you. Each section is broken down to ensure you can easily navigate the requirements and complete your form accurately.

Follow the steps to successfully complete your form online.

- Press the ‘Get Form’ button to access the form and open it in the digital editor.

- Begin with Schedule A – Itemized Deductions. Enter your name(s) as shown on Form 40 and your social security number in the designated fields. Make sure the information is accurate.

- List your medical and dental expenses in the appropriate section, ensuring not to include any expenses that were reimbursed or paid by others. Complete the calculations as indicated.

- Record any taxes you have paid, such as real estate taxes and FICA taxes. Calculate each line as specified.

- Move to the 'Interest You Paid' section and provide the relevant information pertaining to home mortgage interest and points.

- In the Contributions by Cash or Check section, input any charitable contributions you have made, adhering to the instructions provided in the form.

- Complete Schedule B if your interest and dividend income exceeds $1500. List all payers and amounts accordingly.

- Fill out Schedule DC for donation check-offs by entering the desired amounts for various charitable funds as applicable.

- Once you have filled in all relevant fields across Schedules A, B, and DC, review your entries for accuracy and completeness.

- Save your changes and choose from the options to download, print, or share your completed form. Ensure you have a copy for your records.

Begin filling out your AL Schedules A B & DC Form 40 online today for a streamlined filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Use Form 8949 to reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts you report on your return. The subtotals from this form will then be carried over to Schedule D (Form 1040), where gain or loss will be calculated in aggregate.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.