Loading

Get Ga F-1681-v08ga 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the GA F-1681-V08GA online

This guide provides a clear, step-by-step approach to filling out the GA F-1681-V08GA form online. Designed to assist users with varying levels of experience, this resource ensures that you can successfully navigate and complete your application.

Follow the steps to accurately complete the GA F-1681-V08GA online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

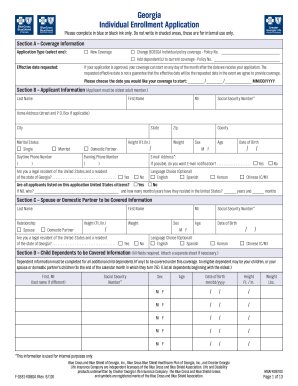

- Begin by providing coverage information in Section A. Specify the application type you are selecting, whether for new coverage, changing existing policy coverage, or adding dependents. Enter the requested effective date for your coverage in MM/DD/YYYY format.

- Next, proceed to Section B for your personal details as the applicant. Fill out your last name, first name, middle initial, social security number, home address, city, state, marital status, height, weight, and contact numbers. Ensure your email address is entered correctly.

- In Section C, provide the information of any spouse or domestic partner you wish to cover. Include required details such as their last name, relationship, social security number, and date of birth.

- For child dependents in Section D, complete all fields for each dependent you wish to include in the coverage. Include first name, last name, social security number, date of birth, age, sex, and any other requested details.

- Section E requires you to select your desired medical coverage plan, deductible, and optional riders. Make your choices carefully, and ensure they match your needs.

- If you wish to include dental coverage, indicate your selection in Section F and specify the type of coverage you desire.

- In Section G, decide whether to apply for Term Life Insurance and provide relevant details if applicable.

- Complete Section H by disclosing any existing health coverage and answering any related questions.

- In Section I, respond to health history questions for each family member listed on the application. Ensure to answer all questions accurately to avoid delays in processing.

- Fill out Section J with your billing options, indicating your preferred payment method, whether a check, credit card, or automatic bank draft.

- Review Section K, which contains significant terms, conditions, and authorizations. Read carefully before signing.

- Finally, sign the application and ensure all required signatures, including those of any dependents over 18, are included. Save your changes, then download, print, or share the completed form as needed.

Complete your GA F-1681-V08GA form online today for a hassle-free application process.

Yes, grant payments are typically reportable on Form 1099 if they meet certain thresholds. This form notifies the IRS about income received from grants, making it important for tax compliance. It is advisable to consult the GA F-1681-V08GA for specific reporting details relevant to Georgia. Staying informed helps you maintain good tax standing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.