Loading

Get Freddie Mac Form 65 6/09

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Freddie Mac Form 65 6/09 online

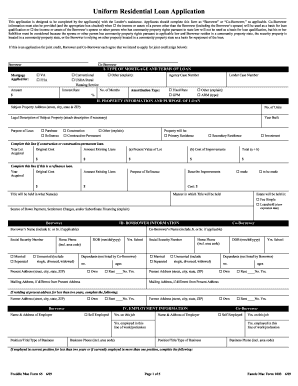

Filling out the Freddie Mac Form 65 6/09 online is a crucial step for individuals seeking a residential loan. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the Freddie Mac Form 65 6/09 online

- Click ‘Get Form’ button to obtain the form and open it in the edit interface.

- Begin by entering the type of mortgage and the terms of the loan. Select from options such as VA, FHA, USDA, or Conventional, and fill in the details for the amount, interest rate, and amortization type.

- Provide property information, including the subject property address, its purpose (e.g., purchase, refinance), and the number of units. Specify the intended use as a primary or secondary residence or investment.

- Under borrower information, enter the names, social security numbers, and contact details for both the borrower and co-borrower. Include marital status and number of dependents for accurate assessment.

- Fill in employment information, including the employer details and monthly income for both borrower and co-borrower. Ensure to include any relevant documentation if self-employed.

- In the monthly income and combined housing expense section, detail the gross monthly income alongside housing expenses. This includes mortgage payments, property taxes, and any other associated costs.

- List assets and liabilities, providing details on bank accounts, investments, and outstanding debts. This section may require you to list specific financial institutions and account numbers.

- Proceed to the declaration section, answering questions related to financial history, including any bankruptcy or foreclosure and other legal matters.

- Read and acknowledge the terms of the application carefully. By signing, you confirm that the information provided is accurate and agreed to the conditions outlined in the document.

- Once completed, you can save changes, download a copy of the form, print it, or share it as necessary.

Complete your Freddie Mac Form 65 6/09 online today to expedite your loan application process.

Perhaps the most notable differences between a Freddie Mac Home Possible Loan and an FHA Loan are the upfront funding fees and mortgage insurance policies. A Freddie Mac Home Possible Loan requires neither an upfront funding fee nor mortgage insurance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.