Loading

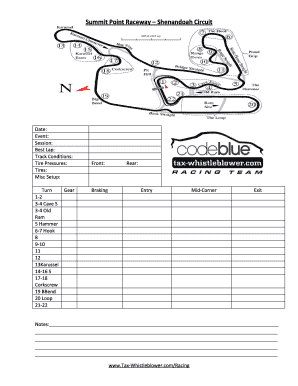

Get Summit Point Shenandoah Debrief Form - Report Tax Fraud

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Summit Point Shenandoah Debrief Form - Report Tax Fraud online

Completing the Summit Point Shenandoah Debrief Form for reporting tax fraud can seem daunting. This guide will provide you with clear, step-by-step instructions to help you navigate the process effortlessly.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to obtain the document and open it in the editing interface.

- Fill in the 'Date' field with the relevant date for your submission. Ensure that it is accurate to provide a clear record of the event you are reporting.

- Enter the 'Event' name related to tax fraud to be reported. Use concise and descriptive language.

- Document the 'Session' details. This could involve specifics about the timeframe or context in which the suspected fraud took place.

- Input the 'Best Lap' if applicable, as this information may be relevant in the context of your report. Otherwise, you may skip this field.

- Specify the 'Track Conditions' at the time of the incident. Providing accurate conditions can help assess the situation effectively.

- List 'Tire Pressures' if they are relevant to the context you are reporting. If not, note this in the respective section.

- Fill out the 'Tires' section if applicable, detailing the types or condition of tires involved in the situation.

- Complete the 'Misc Setup' to document any other relevant setups or adjustments that pertain to your report.

- Use the 'Notes' section to provide any additional context, observations, or specific details that may aid in understanding the nature of the tax fraud you are reporting.

- Review the entire form for accuracy and completeness before finalizing.

- Save your changes. You can also choose to download, print, or share the completed form as needed.

Take action now and complete your documents online.

Use the Form 3949-A, Information Referral if you suspect an individual or a business is not complying with the tax laws. You can submit Form 3949-A online or by mail. We don't take tax law violation referrals over the phone. We will keep your identity confidential when you file a tax fraud report.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.