Loading

Get 760py

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 760PY online

Filling out the 760PY form online is essential for accurately reporting your income and exemptions as a Virginia resident. This guide will provide detailed instructions on how to complete each section of the form, ensuring a smooth and efficient process.

Follow the steps to complete the 760PY form effectively.

- Click ‘Get Form’ button to access the form and open it for editing.

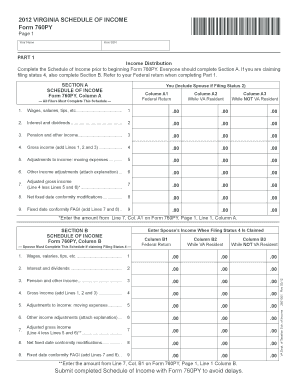

- Complete Part 1 - Income Distribution. Before beginning Form 760PY, start with the Schedule of Income. All users must fill out Section A to report their wages, interest, dividends, and other income. Make sure to refer to your federal return while filling this section.

- In Section A, provide your income details in the designated columns. Column A1 is for your federal return information, A2 for your income while a Virginia resident, and A3 for income earned outside of Virginia. Ensure that all amounts are accurately reported.

- If you are claiming filing status 4, complete Section B. Here, you will need to enter your spouse's income following the same structure—federal return, Virginia resident income, and non-resident income.

- Proceed to Part 2 - Prorated Exemptions Worksheet. This section is used to calculate your allowable personal and dependent exemptions according to the days you resided in Virginia. Each spouse needs to compute their prorated exemptions if applicable.

- Fill out the Moving Information section in Part 3. This will require you to indicate any states you or your spouse moved from and to during the taxable year.

- After completing all sections, review the information for accuracy. If everything is correct, you can proceed to save changes, download, print, or share the form as needed.

Start filling out your 760PY form online today for a seamless filing experience.

2021 Form 760PY - Virginia Part-Year Resident Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.