Loading

Get Dd 2656 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DD 2656 online

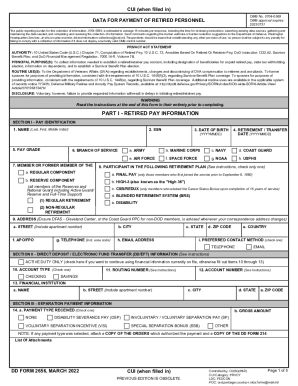

Filling out the DD 2656 form is an essential step for establishing a retired pay account, including designating beneficiaries and managing tax withholding. This comprehensive guide provides clear, step-by-step instructions for completing each section of the form online.

Follow the steps to successfully complete the DD 2656 form.

- Click 'Get Form' button to access the form and open it in the editor.

- In Part I, Section I - Pay Identification, enter your name, social security number, and date of birth in the specified fields. Provide your retirement or transfer date and select your military branch from the list provided.

- Continue in Part I by identifying your retirement plan in Item 8. Choose only one plan that applies to your situation, ensuring you understand the implications of each option.

- In Part I, Section II - Direct Deposit / Electronic Fund Transfer Information, check if you want to use the financial information on file. If not, complete items 10 to 13 with your banking details.

- In Section III - Separation Payment Information, indicate if you received any separation payments and include the gross amount where applicable. Attach supporting documents as instructed.

- In Section IV - Department of Veterans Affairs Disability Compensation Information, acknowledge if you have applied for or are receiving disability compensation and complete the required fields based on your status.

- For Section V - Designation of Beneficiaries for Unpaid Retired Pay, either designate your spouse as the beneficiary or fill in the names and details of other beneficiaries to receive your unpaid retired pay upon your death.

- In Section VI - Federal Income Tax Withholding Information, provide your marital status and the number of dependents. Follow the IRS guidelines to determine your withholding preferences.

- If applicable, complete Section VII - Voluntary State Tax Withholding Information with your designated state and the monthly amount you wish to withhold.

- If you are covered by the Blended Retirement System and wish to elect a lump sum, proceed to Part II - Lump Sum Election, filling in your desired details in the relevant sections.

- In Part III - Survivor Benefit Plan, complete the dependency information and select your desired coverage for the survivor benefit plan, ensuring to include any former spouses if relevant.

- Finalize your submission by signing and certifying the information in Part IV, ensuring that your certification date precedes your retirement date.

- After completing the form, save your changes, and choose to download, print, or share the form as necessary.

Complete your DD 2656 online today to manage your retirement benefits effectively.

Related links form

SBP Costs (Premiums) 6.5% of your chosen base amount, or if less, 2.5% of the first $725.00 of the elected base amount (referred to hereafter as the "threshold amount"), plus 10% of the remaining base amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.