Loading

Get Wpdp004 Employer And Spouse Income Tax Declaration1jul07.doc - Mom Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the WPDP004 Employer And Spouse Income Tax Declaration1Jul07.doc - Mom Gov online

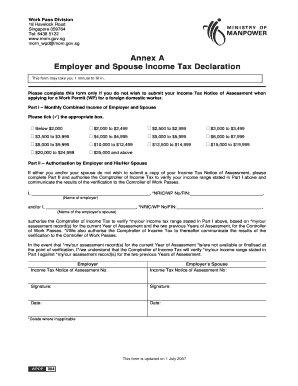

Filling out the WPDP004 Employer and Spouse Income Tax Declaration form is a straightforward process that helps facilitate your application for a Work Permit. This guide provides clear and user-friendly steps to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the tax declaration form.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin with Part I, where you will indicate the monthly combined income of you and your spouse by ticking the appropriate box. The income ranges are clearly listed, so choose the one that applies to your situation.

- Proceed to Part II to provide your authorization. Fill in your name and NRIC/WP number or FIN as the employer, and do the same for your spouse, if applicable.

- In the authorization section, confirm that you allow the Comptroller of Income Tax to verify the income range stated in Part I. Ensure accuracy by reviewing the information before proceeding.

- Complete the fields for the Income Tax Notice of Assessment numbers for both yourself and your spouse. This is required for verification purposes.

- Sign and date the form to authenticate it. Remember to delete any parts of the text that are not applicable to your situation.

- Once all sections are filled out, you can save your changes, download a copy, print the form, or share it as needed.

Complete your documents online today to ensure a smooth application process.

I, ___________________________ (state the name of the person signing the declaration), _____________ (state the designation of the person signing this declaration, like a Director, Partner, Sole Proprietor, Authorized Signatory, etc), acting for and on behalf of _________________ (state the complete name of the ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.