Loading

Get Or Form 735-9002t 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR Form 735-9002t online

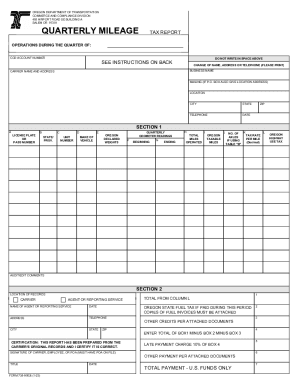

This guide provides a detailed overview of how to complete the OR Form 735-9002t online, ensuring that users can efficiently and accurately submit their quarterly mileage tax report. Whether you’re familiar with digital forms or new to the process, this comprehensive guide will support your needs.

Follow the steps to complete the OR Form 735-9002t online.

- Press the ‘Get Form’ button to obtain the OR Form 735-9002t and open it in your preferred online editor.

- In the account number field, enter your CCD account number as specified on your previous documentation.

- Provide the name and address of your business as registered with the Oregon Department of Transportation.

- For Section 1, begin filling out the vehicle information:

- In Column A, input the license plate or pass number associated with your power unit.

- Enter the state or province that issued the license plate in Column B.

- Fill in your company’s unit number for the power unit in Column C.

- Provide the make of the vehicle in Column D.

- Report the heaviest weight operated per configuration in Column E.

- Input the beginning odometer reading for the reporting period in Column F.

- Record the ending odometer reading in Column G.

- Calculate and enter the total miles operated in Column H (Ending odometer minus Beginning odometer).

- Specify the Oregon taxable miles operated on public roads in Column I.

- Indicate the number of axles for your declared weight in Column J.

- Enter the appropriate tax rate in Column K, based on your vehicle's weight classification.

- Calculate the Oregon Highway Use Tax in Column L (Oregon taxable miles multiplied by the tax rate).

- Proceed to Section 2 to report your payment information: Enter the total fees from Column L in Box 1.

- Input any state fuel tax paid during the period in Box 2, and attach necessary invoices.

- Enter the value of any other credits in Box 3 as noted on your monthly Statement of Account.

- Calculate the total payment by completing Box 4, subtracting Box 2 and Box 3 from Box 1.

- If applicable, calculate late fees in Box 5 as 10% of Box 4.

- Add any additional payments in Box 6 and ensure you attach supporting documents.

- Sum the amounts in Box 4, Box 5, and Box 6 in Box 7 for the total payment due.

- Have the authorized representative sign the report and make sure to include all required information before submission.

- Finally, you may save changes, download, print, or share the completed form as needed.

Start filling out the OR Form 735-9002t online for a smooth reporting experience.

Call the Commerce and Compliance Division (CCD) at 503-378-6699 if you feel your vehicle is exempt from weight-mile tax. Established, tax liable vehicles operating in Oregon must be enrolled in the Oregon weight-mile tax program. At time of enrollment, a vehicle's heaviest operating weight must be declared.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.