Loading

Get Group Insurance Death Claim Intimation Form (credit Policies)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Group Insurance Death Claim Intimation Form (credit Policies) online

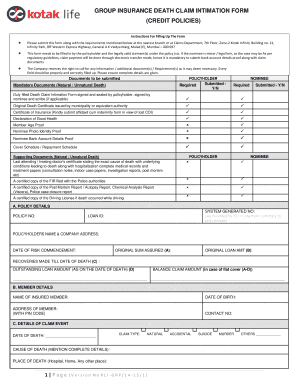

Filling out the Group Insurance Death Claim Intimation Form correctly is essential for ensuring timely processing of claims. This guide provides a clear and supportive step-by-step approach to completing the form online, helping users navigate the necessary information required for submission.

Follow the steps to successfully complete your claim form.

- Click ‘Get Form’ button to access the Group Insurance Death Claim Intimation Form and open it in your preferred editor.

- Begin by entering your policy details in Section A. This includes your policy number, loan ID, and other relevant information. Ensure that all fields are filled accurately.

- Proceed to Section B, where you need to provide details about the insured member, including their name, date of birth, and contact information.

- In Section C, detail the claim event by specifying the date of death and the cause of death, selecting from available options that best fit the situation.

- Moving to Section D, enter the nominee details. Include their name, address, date of birth, and relationship to the insured member.

- Input the nominee's bank account details in Section E. Provide all necessary account information backed with proper identification proof.

- In Section F, include the bank account details of the policyholder, ensuring that the information matches the documentation you will submit.

- Complete Section G by signing the declaration and authorization, confirming the validity of the information provided.

- If applicable, proceed to Section H for the nominee's declaration, ensuring they also sign and understand the implications of the claim.

- Review the entire form for accuracy and completeness. Ensure all mandatory fields are completed.

- Once all details are confirmed, you can save changes, download, print, or share the form as necessary for submission along with required documents.

Complete your Group Insurance Death Claim Intimation Form online today for efficient processing.

Insurance certificate. Original/attested copy of death certificate issued by local municipal authority. Claim form (Lender Borrower/Non Lender Borrower) as applicable. NEFT mandate form attested by bank authorities along with a cancelled cheque or bank account passbook.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.