Get Ca Pers-msd-470 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA PERS-MSD-470 online

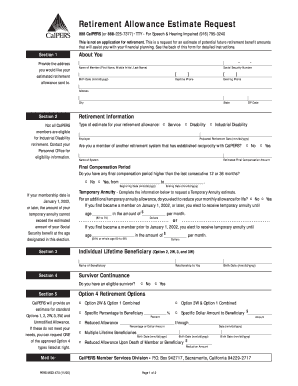

This guide provides comprehensive instructions for filling out the CA PERS-MSD-470 form online. Completing this form correctly is essential for obtaining an estimate of your potential future retirement benefits to aid in your financial planning.

Follow the steps to complete the CA PERS-MSD-470 form successfully.

- Click the ‘Get Form’ button to obtain the CA PERS-MSD-470 form and open it in the designated online editor.

- In Section 1, 'About You', provide your name, Social Security number, birth date, mailing address, and daytime and evening phone numbers. Ensure all information is accurate.

- Move to Section 2, 'Retirement Information'. Indicate the type of estimate you are requesting—whether it’s for service, disability, or industrial disability retirement. Provide your projected retirement date and details regarding any other retirement systems you may belong to.

- Still in Section 2, enter your estimated final compensation amount and specify if there are any final compensation periods higher than the last 12 or 36 months.

- Proceed to Section 3 for 'Temporary Annuity'. Indicate whether you elect to reduce your monthly allowance for life, and fill in the amount and age until which you wish to receive the annuity.

- In this section, you will also designate any individual lifetime beneficiaries, including their names and birth dates.

- Next, in Section 4, answer the question regarding the eligibility of any survivors for continuance benefits. If applicable, provide details on the relationship to you.

- Finally, in Section 5, review the retirement options. If the standard options do not meet your needs, select from the Alternative Options while ensuring that any requests align with CalPERS requirements.

- Once you have filled out all sections of the form, review your information for accuracy. After confirming that all information is correct, you can save the changes, download the form, print it, or share it as needed.

Complete your documents online for a smooth and efficient process.

Get form

The Office of Personnel Management (OPM) calculates disability retirement using specific formulas that consider your high-3 average salary, years of service, and the nature of your disability. They assess your ability to work and may require medical evidence to support your claim. This process ensures fair evaluation and benefits distribution for those unable to continue in their roles. For more insights, consider using resources provided by USLegalForms to navigate through this complex process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.