Loading

Get Usps Pay Stub Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Usps Pay Stub Template online

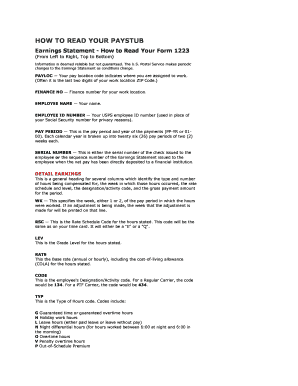

Filling out the Usps Pay Stub Template online can streamline the process of managing your pay information. This guide will provide a clear and concise walkthrough of each component of the form, ensuring you have the necessary information at hand.

Follow the steps to complete your Usps Pay Stub Template online.

- Click ‘Get Form’ button to access the Usps Pay Stub Template. This will allow you to open the form in your preferred online editor.

- Begin by entering your pay location code in the designated field. This code typically represents the last two digits of your work location's ZIP code.

- Input your finance number associated with your work location. This number is essential for accurate record-keeping.

- Fill in your full name as it appears on your employment records under the employee name section.

- Enter your USPS employee ID number in the appropriate field. This number replaces your Social Security number for privacy.

- Specify the pay period by selecting the relevant dates. Each calendar year is divided into twenty-six pay periods of two weeks each.

- For the earnings section, record the details regarding your hours worked, rate schedule, and payments for the specified pay period. Include details for different types of hours earned.

- In the deductions section, provide the amounts for federal and state tax withheld, retirement contributions, and any other relevant deductions.

- Detail your leave status, specifying annual and sick leave used and available. Include any leave without pay taken during the period.

- Finally, review all entries for accuracy. Once completed, you can save your changes, download, print, or share your form as necessary.

Complete your Usps Pay Stub Template online today for convenient management of your earnings and deductions.

Related links form

How to make a pay stub for your employees Start with the employee's total gross pay for the pay period. Add deductions for taxes withheld (federal, state, and local if applicable, as well as FICA). Deduct the employee-paid portion of health insurance premiums. Deduct employee-elected retirement plan contributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.