Loading

Get Ma Schedule C 2004-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Schedule C online

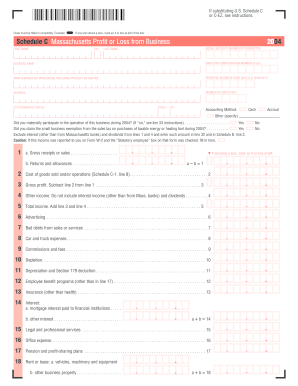

Completing the MA Schedule C is an essential step for individuals reporting profit or loss from their business in Massachusetts. This guide will provide you with clear instructions on how to fill out the form accurately and efficiently online.

Follow the steps to fill out the MA Schedule C online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your first name, middle initial, and last name in the provided fields, followed by your social security number.

- If applicable, input your employer identification number (EIN) in the next section.

- Fill in your business name and provide the primary business or profession, including details about the products or services you offer.

- Refer to the U.S. Schedule C to find and enter your principal business code.

- Input your business address, including city, state, and zip code.

- Indicate the number of employees you have.

- Choose your accounting method from the options: cash, accrual, or other, specifying if necessary.

- Answer the question about your material participation in the business operations.

- Indicate whether you claimed the small business exemption from sales tax.

- Complete lines 1 through 5 by entering your gross receipts or sales, returns and allowances, and calculating your total income.

- Detail your business expenses in lines 6 through 26, making sure to categorize them appropriately.

- Calculate your total expenses and determine your tentative profit or loss on line 28.

- If you have home office expenses, enter them on line 29.

- Complete the Abandoned Building Renovation Deduction on line 30.

- Determine your net profit or loss and enter it on line 31, noting where to report it on Form 1.

- If applicable, answer the question concerning interest or dividend income.

- If necessary, complete the investment risk section on line 33.

- Review all entered information for accuracy, then save your changes.

- You can download, print, or share the completed form as needed.

Start filling out your MA Schedule C online today to ensure accurate reporting!

Schedule C is a tax form used to report business-related income and expenses. This schedule is filled out by self-employed individuals, sole proprietors, or single-member LLCs. A business expense must be ordinary and necessary to be listed as a tax deduction on Schedule C.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.