Loading

Get Form 6163e + Enclosure 6167e, Application For Refund Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 6163e + Enclosure 6167e, Application For Refund Of Finnish Withholding Tax on Dividends online

This guide will help you understand how to effectively fill out the Form 6163e and its enclosure, the Enclosure 6167e, for requesting a refund of Finnish withholding tax on dividends. By following the steps outlined in this guide, you can complete the application process smoothly and accurately online.

Follow the steps to successfully fill out the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

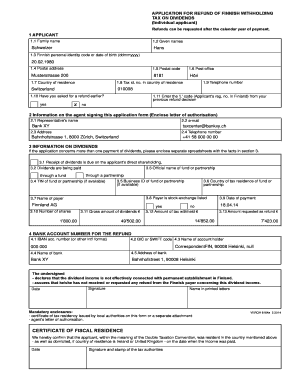

- Fill out the applicant section (1). Include your family name, given names, Finnish personal identity code or date of birth, postal address, postal code, post office, country of residence, tax ID number in your country of residence, and telephone number.

- Indicate if you have applied for a refund earlier and enter the 'L' code from your previous refund decision, if applicable.

- In section 2, provide information about the agent signing the application form. Include the representative's name, email, address, and telephone number. Remember to enclose the letter of authorization.

- Complete section 3 with information on the dividends. Clearly state the receipt of dividends due on your direct shareholding or through a fund/partnership. Include the official name, TIN, business ID of the fund or partnership, name of the payer, number of shares, gross amount of dividends, tax withheld, date of payment, and the amount you are requesting as a refund.

- In section 4, enter your bank account number for the refund, including the IBAN, BIC or SWIFT code, and the name of the account holder along with the name and address of the bank.

- Read and agree to the declarations regarding dividend income and refunds, then provide the date and your signature, along with your name in printed letters.

- Ensure all mandatory enclosures are included, such as the certificate of tax residency and the agent's letter of authorization.

- Finally, save your changes, download the form, print it for your records, or share it as needed, and submit the completed form to the Helsinki Area Tax Office.

Start filling out your documents online to request your refund today!

To request a refund of your withholdings for previous tax years, please contact the IRS at 1-800-829-1040 for Federal tax withholding refund and your State Revenue Office for state tax withholding refund. If we are not currently withholding State tax, you must call your State Tax office for a refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.