Loading

Get Application Under Section 281 Of Income Tax Act In Word Format

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application Under Section 281 Of Income Tax Act In Word Format online

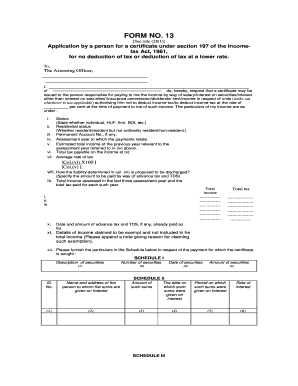

Filling out the Application Under Section 281 of the Income Tax Act is an important step for individuals seeking a certificate for no tax deduction or reduced tax deduction. This guide will help you navigate the process of completing this form online with ease.

Follow the steps to complete the application accurately.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering your personal details in the first section. Provide your name and address in the designated fields. This information is necessary for identifying the applicant.

- Specify the type of income you are applying for by marking the applicable options such as salary, interest on securities, rent, or insurance commission.

- Indicate whether you are an individual, Hindu Undivided Family (HUF), firm, or any other entity. Also, state your residential status as resident, resident but not ordinarily resident, or non-resident.

- Fill in your Permanent Account Number (PAN) if you have one. This number is essential for tax identification in India.

- Provide the assessment year related to the payments that necessitate this certificate.

- Estimate your total income for the previous year relevant to the assessment year and fill out the total tax payable based on the estimated income.

- Calculate your average rate of tax by applying the formula provided in the form (total tax payable divided by total income, multiplied by 100).

- Describe how you plan to discharge the tax liability, including specific amounts for advance tax and Tax Deducted at Source (TDS).

- Complete the section requiring details of the income assessed in the past three assessment years along with the associated taxes paid.

- Provide explanations for any income you claim to be exempt and attach any necessary documentation.

- Detail the payments for which the certificate is sought by completing the relevant schedules for securities, insurance commissions, salary, and other incomes.

- Review all the entered information for accuracy and completeness before finalizing your application.

- Once completed, you can save your changes, download the form, print it, or share it as needed.

Start filling out your application online today to ensure your request is processed smoothly.

Section 281 exists in order to restrict the chances of assessees transferring their assets to evade taxes. One must note that Section 281 is only applicable when the tax amount or other surcharge is more than Rs. 5,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.