Loading

Get Wv Gsr-01 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WV GSR-01 online

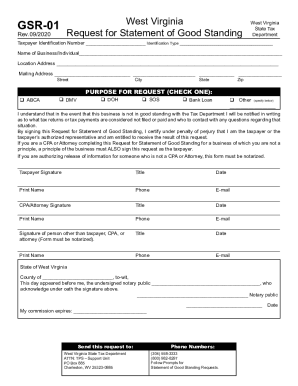

The WV GSR-01 form is a Request for Statement of Good Standing issued by the West Virginia State Tax Department. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring a smooth and successful submission process.

Follow the steps to complete the WV GSR-01 online efficiently.

- Press the ‘Get Form’ button to access the document and open it for editing.

- Fill in the 'Taxpayer Identification Number' field with the appropriate number assigned to the business or individual. Make sure this information is accurate to avoid processing delays.

- Select the 'Identification Type' that applies to you or your business. This could be a Social Security Number for individuals or a Federal Employer Identification Number for businesses.

- Enter the 'Name of Business/Individual' clearly. Ensure this matches the name registered with the State Tax Department.

- In the 'Location Address' section, provide the physical address of the business or individual. This should include the street, city, state, and zip code.

- Complete the 'Mailing Address' fields if different from the location address. Include the street, city, state, and zip code.

- Indicate the purpose for the request by checking one of the specified options. If selecting 'Other,' be sure to specify the purpose in the provided space.

- Read the statement regarding notification of non-good standing carefully. This is essential to understand the implications of your request.

- Sign and date the form in the 'Taxpayer Signature' section. If applicable, provide your title and contact information.

- If a CPA or attorney is completing the form, they must also sign in the designated area. If someone other than the taxpayer is signing, ensure the form is notarized.

- Review all filled sections for accuracy before finalizing the document. Then, save the changes to ensure your information is stored.

- You can now download, print, or share the form as needed, or prepare it for submission to the West Virginia State Tax Department.

Complete your WV GSR-01 online today to ensure timely processing of your Statement of Good Standing.

To check the status of your West Virginia state refund online, go to https://mytaxes.wvtax.gov/?link=refund. Then, click “Search” to find your refund. 1-304-558-3333 or 1-800-982-8297.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.